Table of Investor-State Claims

See all corporate investor-state cases and claims launched under U.S. ‘free trade’ deals.

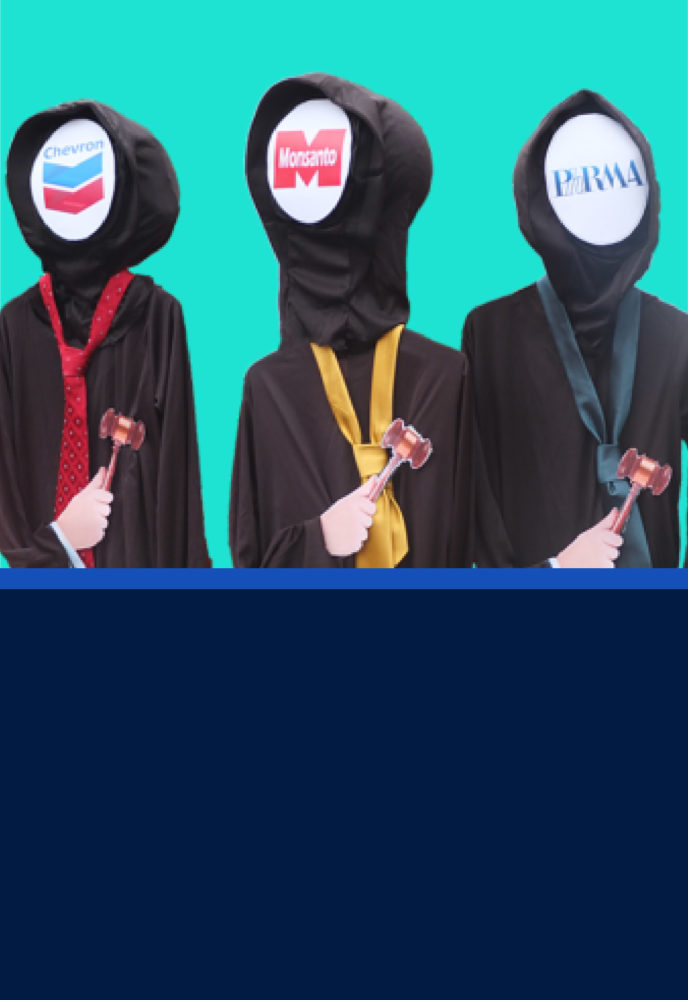

Today’s "trade" agreements grant new rights to multinational corporations to sue governments before a panel of three corporate lawyers. These lawyers can award the corporations unlimited sums to be paid by taxpayers, including for the loss of expected future profits, on claims that a nation’s policy violates their rights. Their decisions cannot be appealed.

Here are some resources that advocates and researchers are using to fight to eliminate the ISDS corporate power grab.