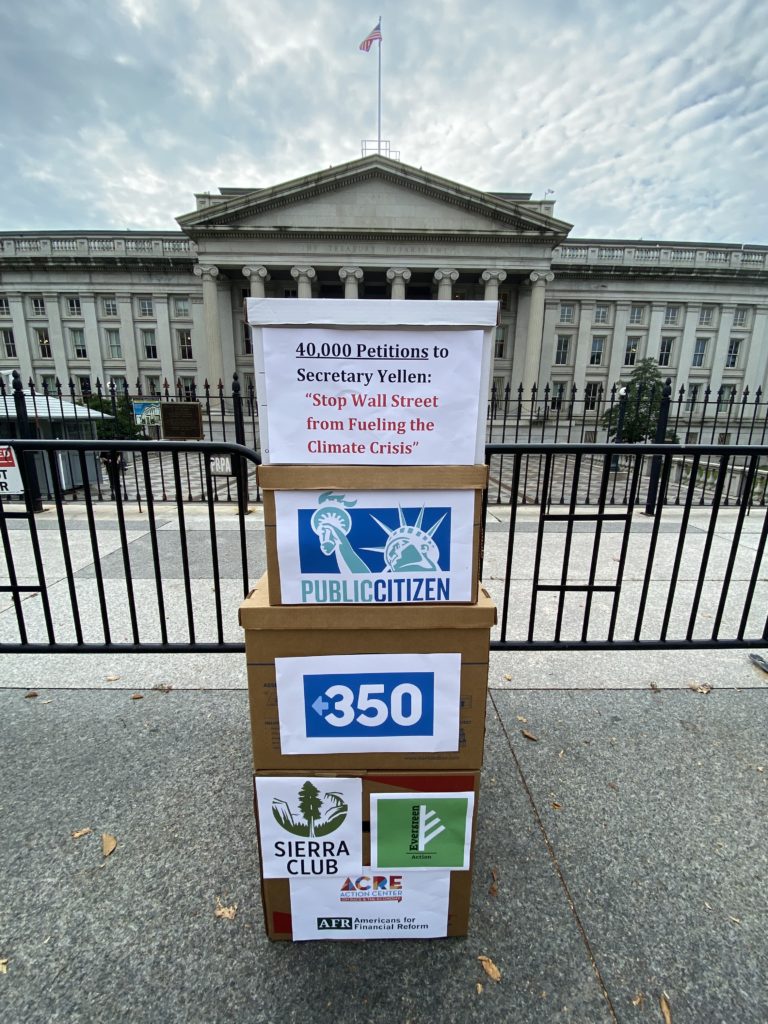

40,000 Petitioners Urge Secretary Yellen to Lead Strong Climate Action Plan in Upcoming Report

WASHINGTON, D.C. — Public Citizen, Sierra Club, 350.org, Americans for Financial Reform, Evergreen Action, and Action Center on Race and the Economy today delivered more than 40,000 petition signatures to U.S. Treasury Secretary Janet Yellen demanding that an upcoming report highlight the gravity of climate threats to our financial system and identify concrete steps that financial regulators should take to address them.

The Treasury Department is expected to publish the report on Monday, Oct. 18th, following President Joe Biden’s Executive Order on Climate-Related Financial Risk in May and the release today of a strategic roadmap from the White House that sets the stage for the Treasury report.

Earlier this week, Public Citizen and Americans for Financial Reform released detailed expectations for the report. These expectations followed a letter to Secretary Yellen, signed by nearly 40 organizations, calling for a strong report that identifies the full suite of tools financial regulators have to mitigate systemic climate risk. On October 29, following the release of this report and ahead of COP26, youth activists and communities across the U.S. and around the world are planning a major day of action targeting major financial institutions and regulators to call for urgent climate action.

National climate, financial regulation, and racial and economic organizations issued the following statements:

David Arkush, director of Public Citizen’s climate program said: “This morning, the White House released a report that recognizes the climate crisis is destabilizing the financial system and rightly tells regulators to take a proactive, precautionary approach in responding. Secretary Yellen must listen to the thousands of advocates calling for a report implementing exactly this strategy. She and Fed Chair Jerome Powell must embrace acting immediately, not just studying the issue and requiring disclosures. That means steps like integrating climate risk into bank oversight and starting to curb Wall Street’s risky fossil finance.”

Brett Fleishman, head of finance campaigns at 350.org, said: “We know Secretary Yellen recognizes the dangers of the fossil-fueled climate crisis on our communities, financial system, and economy. It’s time for her to take swift and responsible action by limiting the risky practices of climate destroyers on Wall Street with strong provisions in this report. That’s why we’re making the Peoples’ voices heard, and rising for a Fossil Free Future on October 29.”

Ben Cushing, fossil-free finance campaign manager at the Sierra Club, said: “Financial regulators can and must use their authority to rein in Wall Street’s risky investments in the fossil fuels that are driving the climate crisis and threatening to push us into economic crisis as well. We urge Secretary Yellen to listen to the tens of thousands of Americans who have spoken out and asked her to protect our communities, small businesses, pensions, and families by laying out a bold framework for agencies to use all available tools to prevent a climate-driven Great Recession.”

Lena Moffitt, campaigns director for Evergreen Action, said: “Secretary Yellen has said it herself: the climate crisis is an ‘existential threat’ to our entire financial system. To protect the economic security of every American, financial regulators must take swift action to mitigate climate-related financial risks, including addressing the financing of the fossil fuels that drive those risks. On behalf of thousands of grassroots climate leaders from across the country, we are proud to deliver this clear message to Secretary Yellen: as the Chair of the Financial Stability Oversight Council, she must lead the charge for every financial regulatory agency to protect our economy from a climate-fueled crash.”

Alex Martin, senior policy analyst at Americans for Financial Reform, said: “40,000 advocates agree: Treasury’s climate finance report must lay out a bold roadmap of policy recommendations for each of the financial regulators to tackle climate risk and advance environmental and racial justice. And this report must mark the beginning of a new phase of the climate financial regulatory agenda, moving beyond risk assessment and disclosure and into risk mitigation to safeguard the economy and facilitate a clean energy transition.”