Lobbying After Disaster

Norfolk Southern Corporation Lobbying Spending in the Year Since The Ohio Train Derailment and Toxic Fire

Key Findings

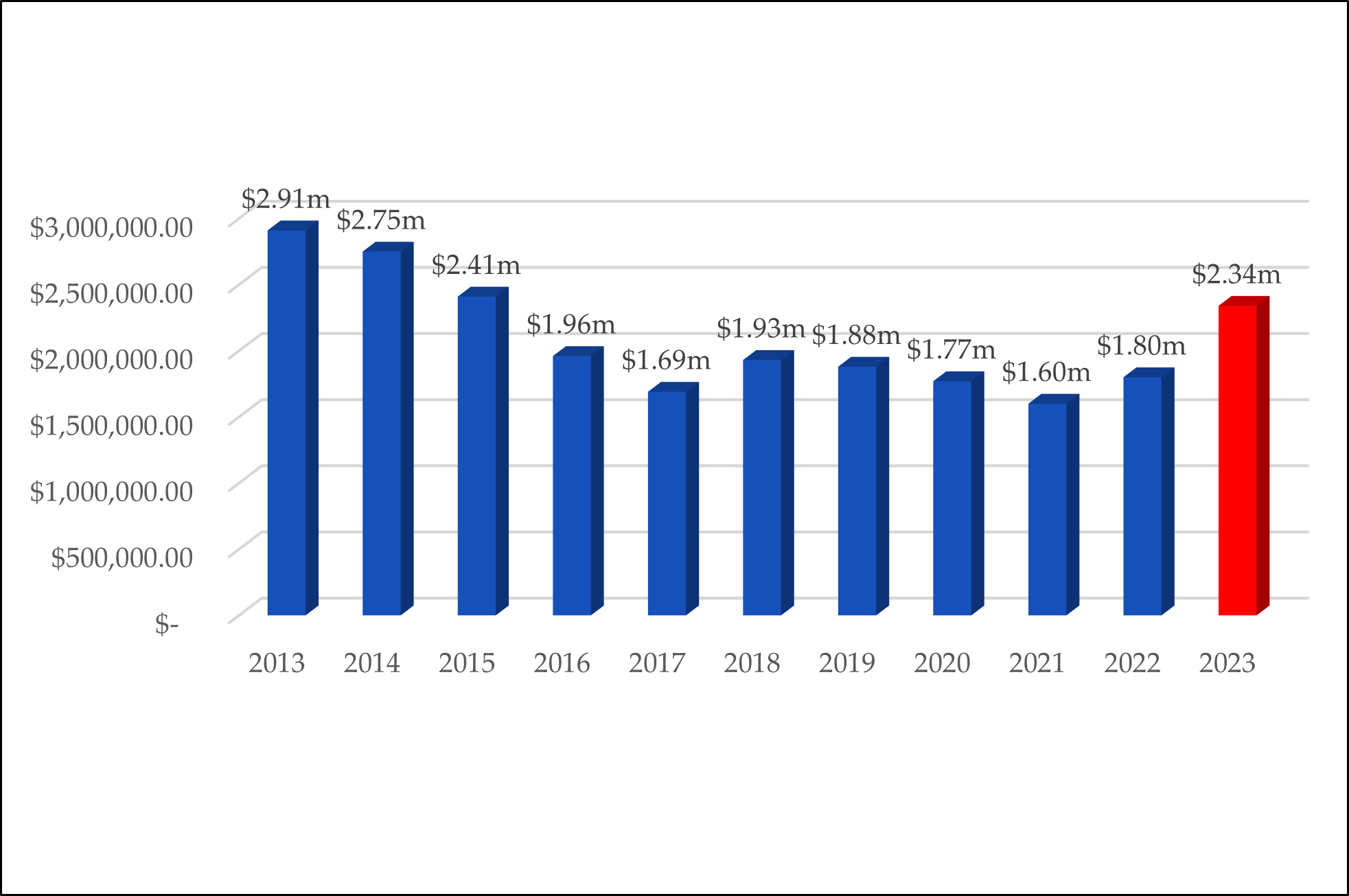

- In the decade before the February 3, 2023 Norfolk Southern train derailment that spewed hazardous materials over East Palestine, Ohio, near the Ohio-Pennsylvania border[1], federal filings show that Norfolk Southern spent $20,700,000 to lobby Congress, federal agencies, and the White House, according to an analysis of OpenSecrets data by Public Citizen.[2]

- In the year after the Ohio train derailment, Norfolk Southern’s federal lobbying spending not only continued but significantly increased. Norfolk Southern’s reported federal lobbying spending in 2023 was $2,340,000.[3]

- Norfolk Southern’s federal lobbying spending of $2,340,000 in 2023 was $540,000 more than its federal lobbying spending of $1,800,000 in 2022, a 30% increase. Norfolk Southern’s federal lobbying spending total in 2023 was its highest reported federal lobbying spending total since 2015.[4]

- In 2023, Norfolk Southern retained 41 federal lobbyists, including more than two dozen former staffers in Congress, federal agencies, and the White House and 3 former Members of Congress: former U.S. Senate Majority Leader Trent Lott (R-MS), former U.S. Senator John Breaux (D-LA), and former U.S. Representative Patrick Meehan (R-PA).[5]

- Norfolk Southern also has a substantial lobbying presence on the state level in Ohio and Pennsylvania.[6]

Introduction

This report examines the lobbying spending by Norfolk Southern and its subsidiaries in the year since the February 3, 2023, Ohio train derailment as a case study of the current state of corporate lobbying disclosure and to explore whether more robust corporate lobbying disclosure could benefit investors and the public.

In the wake of the February 3, 2023 Norfolk Southern train derailment that released black plumes of toxic fumes into the sky over East Palestine, Ohio, news reports revealed that the company had been “lobbying against stricter safety regulations.”[7]

For example, Ohio state news reports that came out after the derailment revealed that Norfolk Southern had for years employed influential lobbyists on the state level in Ohio who “repeatedly fended off legislation imposing minimum staffing requirements”[8] and “were devoted to defeating legislation that would have established tougher safety standards for rail yards and train operations.”[9]

Similarly, the Washington Post reported that, in November 2022, three months before the derailment, Norfolk Southern’s CEO and top executives had met with U.S. Department of Transportation Secretary Pete Buttigieg and government officials.[10] At that meeting, according to the Post, a government memorandum revealed that Norfolk Southern had “raised the issue” of a proposed federal rulemaking to institute train crew size safety requirements that regulators argue would, by requiring trains to have 2-person crews in most cases, enable a better response to derailments and other emergencies.[11] According to the memo, at the meeting Norfolk Southern “conveyed” a series of “concerns” about the proposed safety rule, including increased labor costs, reduced flexibility, and impeding its use of “advanced technologies” to save money and be more cost-competitive.[12]

Six months after the derailment, Congress remained “deadlocked” on enacting new provisions for train safety that had been introduced as the Railway Safety Act by a bipartisan group of Senators led by U.S. Senator Sherrod Brown (D-Ohio) and supported by his fellow Ohio Senator J.D. Vance (R-Ohio).[13] Senator Brown released a statement in September 2023 “demanding action from Norfolk Southern,” including that the company “stop their financial support for the freight rail industry’s lobbying against the Railway Safety Act.”[14] “The company claims they aren’t lobbying against our bill,” Sen. Brown’s statement continued, “but they continue to fund the industry lobbyists that have made it their mission to kill our bipartisan safety act.”[15] In addition, Senator Brown insisted that Norfolk Southern “must cease its opposition to the safe operation of trains with 2-person crews, and call on the freight rail industry to end its lawsuit against the State of Ohio.”[16]

In January 2024, on the eve of the one-year anniversary of the Norfolk Southern Ohio train derailment, the federal Railway Safety Act still had not received a vote on the Senate Floor, much less passed Congress.[17] While the Federal Railroad Administration had submitted its federal rule on train crew staffing for final review by January 2024, a final rule had not yet been released.[18]

According to documents filed with Congress by the company and its lobbyists, as required by the federal Lobbying Disclosure Act and compiled by the national research and government transparency group OpenSecrets, in the decade before the Ohio derailment, Norfolk Southern spent more than $20 million on lobbying in Washington, D.C. to influence Congress, the White House, and federal agencies.[19] According to a review of Norfolk Southern’s 2023 lobbying filings, the company spent more than $2.3 million in 2023 paying 41 lobbyists to lobby the federal government.[20]

A closer look at these records reveals that Norfolk Southern’s 41 federal lobbyists in 2023 featured a bipartisan mix of Washington power-players: former U.S. Senate Majority Leader Trent Lott (R-MS), former U.S. Senator John Breaux (D-LA), and former U.S. Representative Patrick Meehan (R-PA). Norfolk Southern’s lobbyists also included dozens of former White House aides, regulatory agency officials, and Congressional staff.[21]

The range of issues Norfolk Southern lobbyists reported lobbying on in Washington during 2023 included the “Railway Safety Act of 2023,” “rail safety,” and “issues related to railroad staffing requirements” and a variety of other issues.[22] However, federal lobbying disclosures don’t paint a full lobbying picture. Currently, federal lobbyists aren’t required to disclose exactly what people they lobbied, how much they spent lobbying on a specific issue, or even whether they were lobbying for or against a bill.[23]

Norfolk Southern does disclose on its corporate website the fact that it engages in lobbying via a webpage titled “Political Activity and Contributions.”[24] A section of that page called “Lobbying” provides website links to search for Norfolk Southern’s lobbying reports that are filed with the U.S. House of Representatives and the U.S. Senate.[25] No detail about Norfolk Southern’s lobbying strategy, lobbying objectives, or its state-level lobbying spending is disclosed on that page.[26]

The disconnect between massive corporate lobbying spending and limited corporate lobbying disclosure is a problem far bigger than just one company or one industry. In 2022, federal lobbying expenditures hit $4.1 billion, the highest level since 2010, according to disclosures analyzed by OpenSecrets.[27] Yet the actual impact of all that lobbying spending is largely obscure. For this reason, last November, a group of influential U.S. Senators sent a letter to the Chair of the Securities and Exchange Commission (SEC or Commission) calling on the agency to begin the process of developing rules to require the disclosure to investors of corporate lobbying spending, lobbying strategy, and any related potential financial risks.[28]

For more than a decade, shareholders at major companies have filed shareholder proposals supporting improved lobbying spending and activity disclosure.[29] Shareholders are again expected to file resolutions in 2024 calling on companies to comprehensively disclose their lobbying spending and activities to investors.[30]

Full disclosure of lobbying spending and activities by companies is crucial to enabling the public and investors to assess whether a company’s behind-closed-doors lobbying is consistent with its publicly articulated goals and promises and enable investors to evaluate any potential financial or reputational risks that a company’s lobbying may present to consider as part of the “’total mix’ of information” they rely on to make an informed investment decision.[31]

I. Norfolk Southern Lobbying Spending

Norfolk Southern has long spent heavily on lobbying in Washington, D.C.[32] In the decade before the Ohio derailment disaster, Norfolk Southern spent more than $20 million paying its own in-house lobbyists and outside contract lobbyists to lobby Congress, federal agencies, and the White House.[33] (see Figure 1) This direct lobbying spending by Norfolk Southern came on top of the tens of millions spent on lobbying by the Association of American Railroads, the trade organization representing large train companies, including Norfolk Southern.[34]

A. Norfolk Southern 2023 Federal Lobbying Spending

In the year since the Ohio derailment, Norfolk Southern not only continued but significantly increased its spending to lobby the federal government.

According to Norfolk Southern’s lobbyist filings for calendar year 2023 – which includes the month of January 2023 prior to the Ohio derailment on February 3, 2023 – Norfolk Southern’s federal lobbying spending in 2023 totaled $2,340,000. [35] Norfolk Southern’s federal lobbying spending in 2023 increased by 30% over the $1,800,000 in lobbying spending the previous year and was the most Norfolk Southern reported spending on federal lobbying since 2015.[36] (see Figure 1)

Figure 1 – Norfolk Southern Federal Lobbying Spending, 2013-2023

Source: Public Citizen analysis of Norfolk Southern federal lobbying data from OpenSecrets. Lobbying totals include spending on all issues.[37]

B. Norfolk Southern 2023 Federal Lobbyists

Norfolk Southern’s federal lobbyists in 2023 were well-positioned to influence policy and regulations since most of them previously worked inside the federal government or are former elected Members of Congress themselves. A review of Norfolk Southern’s federal lobbying filings found that, in 2023, Norfolk Southern employed 41 Washington lobbyists, including 3 former members of Congress and more than two dozen former staffers in Congress, federal agencies, and the White House.[38]

Norfolk Southern’s federal lobbyists in 2023 included the following former Members of Congress:

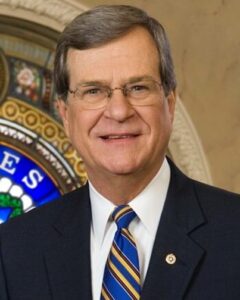

- Former U.S. Senate Majority Leader Trent Lott (R-MS),[39]

(Official government photo of Trent Lott, http://tinyurl.com/27xc486n)

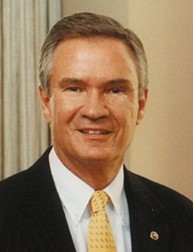

- Former U.S. Senator John Breaux (D-LA),[40]

(Official government photo of John Breaux, http://tinyurl.com/5ehz5dsn)

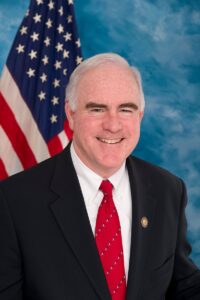

- Former U.S. Representative Patrick Meehan (R-PA).[41]

(Official government photo of Patrick Meehan, http://tinyurl.com/bderp2cx)

C. Norfolk Southern 2023 Federal Issues Lobbied

The lobbying spending data reviewed in this report is publicly available because of the legal disclosure requirements of the federal Lobbying Disclosure Act. While some disclosure is certainly better than none, federal corporate lobbying disclosure is inadequate. The Lobbying Disclosure Act does not require federal lobbyists to disclose which people they lobbied, how much was spent lobbying on a specific issue – current lobbying reports only require disclosure of spending on all issues combined – or even whether the lobbyists were lobbying for or against the bills they reported lobbying on.[42]

A review of Norfolk Southern’s federal lobbying filings found that, in 2023, Norfolk Southern’s lobbyists reported lobbying on 9 bills including the Railway Safety Act of 2023 (S. 576 and H.R. 1674) and the Railway Accountability Act (S. 1044).[43] The reports also disclose Norfolk Southern’s lobbyists lobbying on 31 issues, including the specific – “railroad staffing requirements,” “highway-rail grade crossings,” and “meetings with members and staff about East Palestine Train Derailment” and the more general – “monitor safety related legislation,” “general railroad and transportation issues,” and “support for legislation that assures all modes of Transportation have the opportunity to do business in a fair market.”[44]

D. Norfolk Southern State Lobbying Spending

In addition to its federal lobbying spending, Norfolk Southern has engaged in robust lobbying spending on the state level as well.

News reports that came out after the February 2023 Ohio derailment revealed that Norfolk Southern had for years employed influential state lobbyists in Ohio who “repeatedly fended off legislation imposing minimum staffing requirements”[45] and “were devoted to defeating legislation that would have established tougher safety standards for rail yards and train operations.”[46]

Similarly, in the wake of the derailment, which happened close to the Ohio-Pennsylvania border, news reports revealed that, since 2007, Norfolk Southern had “spent more than $5.4 million on lobbying in [Pennsylvania’s state capital] Harrisburg, with more than $355,000 spent lobbying state lawmakers in 2022.”[47]

Unfortunately, a mishmash of state lobbying disclosure laws, differing terminology, lax requirements, and data scattered across many systems can make it difficult, if not impossible, for concerned citizens or thoughtful investors to understand the full extent of a company’s state-level lobbying. This has created, what a recent report by the Sustainable Investments Institute, commissioned by Public Citizen, called The Corporate State Lobbying Black Hole.[48]

II. Strengthening Corporate Lobbying Transparency

A. Federal Lobbying Spending Hits Record High

In 2022, federal lobbying expenditures hit $4.1 billion, the highest level since 2010, according to federal lobbyist filings analyzed by OpenSecrets.[49] The vast majority of that lobbying spending – 87% – was spent by business groups and corporations.[50]

However, the actual impact of that corporate lobbying spending is obscured by inadequate disclosure rules. As noted previously, federal lobbying disclosure laws require little specificity.[51] State-level lobbying disclosure requirements vary widely and may not be robust, easily accessible, or comparable across state lines.[52]

In addition to the general public’s interest in knowing who is influencing government policy and how they’re doing it, there is a group of people with a particularly important interest in strong corporate lobbying disclosure: investors.

Lobbying activities create costs and risks for a corporation – and by extension, investors. Lobbying also generates direct costs, distributing profits to lobbyists instead of to shareholders.

Research has found that lobbying may expose a company to reputational risks if it runs contrary to a company’s publicly stated positions, demonstrating “values incongruity.”[53] A company’s reputation is a critical component of shareholder value. High reputational rank corresponds with strong financial performance, and reputational damage can be costly and challenging for a company to ameliorate.[54] Consistent, comparable, and comprehensive disclosure of corporate lobbying expenditures would allow investors to consider the extent of lobbying activities by companies in which they have invested or are considering investing as part of the total mix of material information a reasonable investor evaluates when making investment decisions.[55]

B. Senators Ask the SEC to Require Lobbying Disclosure

Due to the inadequacy of existing corporate lobbying disclosures, last November, a group of five United States Senators sent a letter to the Chair of the SEC calling on the Commission to begin the process of developing rules to require publicly traded companies to disclose to investors their corporate lobbying spending, lobbying strategy, and any related potential financial risks.[56]

The letter from Senate Banking, Housing, and Urban Affairs Committee Chair Sherrod Brown and Committee Members Sen. Elizabeth Warren (D-Mass.), Sen. Jon Tester (D-Mont.), Sen. Tina Smith (D-Minn.), and Sen. John Fetterman (D-Pa.) stated:[57]

In the absence of strong lobbying disclosure rules, investors are largely kept in the dark regarding the policy campaigns they are indirectly funding. This raises concerns that investors may be funding lobbying activities that are counter to the stated missions of the companies they have invested in, that are counter to their own beliefs, or that may even erode the value of their investment. . . . A company’s lobbying activity is of material importance to its investors, and it is past time for the SEC to require strong disclosure rules to ensure investors have access to that information.Letter to The Honorable Gary Gensler, Chair, U.S. Securities Exchange Commission from U.S. Senators Elizabeth Warren, Sherrod Brown, Jon Tester, Tina Smith, and John Fetterman (November 15, 2023)

The Senators asked the SEC to begin the process of considering and potentially issuing a new rule that would, “require registered companies to disclose, as relevant, any lobbying strategy, the aggregate amount of direct or indirect contributions to registered state and federal lobbyists, and any material risks related to or arising from the registrant’s lobbying strategy and expenditures.”[58]

III. Investor Support for Corporate Lobbying Disclosure

Investors have demonstrated strong and sustained support for disclosure of more information about corporate lobbying. According to the Sustainable Investments Institute, since 2010 investors have filed nearly 600 shareholder resolutions asking companies to voluntarily provide more information to investors about how much they spend on their direct federal, state, and local lobbying, how much they spend on trade association lobbying and other forms of “indirect” lobbying, and how they oversee that activity.[59] A coalition of investors supporting these initiatives is comprised of public pension funds, labor funds, asset managers, institutional investors, religious investors, and individual investors and supported by a broad range of securities experts, academics, investors, and transparency advocates.[60] In 2024, investors are expected to file shareholder resolutions at a number of major companies calling for improved political spending and lobbying disclosure.[61]

Some companies have responded to investor interest and adopted a voluntary lobbying disclosure policy. Twice as many companies in the S&P 500 now voluntarily report federal lobbying expenditures to investors than did in 2015, according to the Sustainable Investments Institute.[62] However, voluntary corporate lobbying disclosure can be vague, cursory, or omit important information such as lobbying strategy, oversight, and ”indirect” lobbying spending through trade associations and other third party entities.

Furthermore, almost no companies disclose state-specific information about their state lobbying activities: 98% of S&P 500 firms do not disclose state-specific lobbying spending data to investors and 97% do not report a combined or aggregate spending total for state lobbying, according to a recent report.[63]

IV. Conclusion

Corporate lobbying has a major impact on American government policy and, in turn, on American life. With lobbying spending reaching record highs, greater disclosure of the nature and extent of that corporate lobbying activity will provide the public with critical insight into how government policy is being shaped, often behind closed doors and out of public view. It will also provide investors with valuable information about both the potential benefits and risks that lobbying activity might create for companies and their existing or future shareholders.

This report found that, in the year after the Ohio derailment, Norfolk Southern not only continued but significantly increased its federal lobbying spending activity with a collection of influential lobbyists including former Members of Congress and well-connected former White House, federal agency, and Congressional staffers. This review of Norfolk Southern’s lobbying spending in 2023 shines a light on the need for robust corporate lobbying disclosure in 2024 and beyond.

Sources

[1] Congressional Research Service, East Palestine, OH, Train Derailment and Hazardous Materials Shipment by Rail: Frequently Asked Questions (February 24, 2023), https://sgp.fas.org/crs/misc/R47435.pdf.

[2] Public Citizen analysis of Norfolk Southern federal lobbying data for 2013-2022 from OpenSecrets (viewed on January 24, 2024), http://tinyurl.com/bdf2ck4z.

[3] Public Citizen analysis of Norfolk Southern federal lobbying data for 2023 from OpenSecrets (viewed on January 26, 2024), http://tinyurl.com/bdf2ck4z.

[4] Public Citizen analysis of Norfolk Southern federal lobbying data from OpenSecrets (viewed on January 26, 2024), http://tinyurl.com/3xrtj9rv.

[5] Lobbyists representing Norfolk Southern, 2023, OpenSecrets (viewed on January 25, 2024), http://tinyurl.com/ujcxenhw.

[6] See Darrel Rowland, Norfolk Southern plied Ohio politicians with campaign cash, extensive lobbying, WSYX ABC-TV Channel 6 (February 20, 2023) http://tinyurl.com/mram2a29 and Justin Sweitzer, Norfolk Southern has spent millions on lobbying and political donations. Will it pay off?, City & State Pennsylvania (April 3, 2023), http://tinyurl.com/3ufub92t.

[7] Zack Budryk, Democratic senators grill Norfolk Southern CEO on deregulatory lobbying, The Hill (March 9, 2023), http://tinyurl.com/yvajpvc8; and Prem Thakker, Norfolk Southern Has Thrown Roughly $100 Million Into Politics Since 1990, The New Republic (February 20, 2023), http://tinyurl.com/4hxc34xx.

[8] Nick Evans, Will Norfolk Southern’s political spending help shield it from consequences?, Ohio Capital Journal (March 2, 2023), http://tinyurl.com/39c998x4.

[9] Darrel Rowland, Norfolk Southern plied Ohio politicians with campaign cash, extensive lobbying, WSYX ABC-TV Channel 6 (February 20, 2023), http://tinyurl.com/mram2a29.

[10] Ian Duncan, Luz Lazo, Michael Laris, Before Ohio derailment, Norfolk Southern lobbied against safety rules, Washington Post (February 18, 2023), http://tinyurl.com/23aszpen.

[11] Id. and Memorandum from Alan H. Nagler, Senior Attorney, Office of the Chief Counsel, U.S. Department of Transportation (January 6, 2023), http://tinyurl.com/m4ukz7f6.

[12] Memorandum from Alan H. Nagler, Senior Attorney, Office of the Chief Counsel, U.S. Department of Transportation (January 6, 2023), http://tinyurl.com/m4ukz7f6.

[13] Stephen Groves and Josh Funk, 6 months after the East Palestine train derailment, Congress is deadlocked on new rules for safety, Associated Press (August 3, 2023), http://tinyurl.com/ntdhewje.

[14] Demanding Action From Norfolk Southern, Newsletter from the Office of U.S. Senator Sherrod Brown (September 25, 2023), http://tinyurl.com/5z2j3nxp.

[15] Id.

[16] Id.

[17] Stephanie Elverd, Railway Safety Act Still Awaits Consideration in Congress, The Intelligencer/Wheeling News-Register (January 1, 2024), http://tinyurl.com/2rtws7h9.

[18] Joanna Marsh, FRA’s train crew size rule moves forward, FreightWaves (January 3, 2024), http://tinyurl.beencom/mzhfyhhf.

[19] Public Citizen analysis of Norfolk Southern federal lobbying data for 2013-2022 from OpenSecrets (viewed on January 24, 2024), http://tinyurl.com/bdf2ck4z.

[20] Public Citizen analysis of Norfolk Southern federal lobbying data for 2023 from OpenSecrets (viewed on January 26, 2024), http://tinyurl.com/bdf2ck4z.

[21] Lobbyists representing Norfolk Southern, 2023, OpenSecrets (viewed on January 25, 2024), http://tinyurl.com/ujcxenhw.

[22] Issues Lobbied By Norfolk Southern 2023, OpenSecrets (viewed on January 25, 2024), http://tinyurl.com/4apen84p and http://tinyurl.com/34sn3wab.

[23] Craig Holman, Public Citizen, Origins, Evolution and Structure of the Lobbying Disclosure Act (May 11, 2006), http://tinyurl.com/2epswa4p.

[24] Norfolk Southern website, Political Activity and Contributions-Lobbying, www.norfolksouthern.com, (accessed January 25, 2024), http://tinyurl.com/44fb62yb.

[25] Id.

[26] Id.

[27] Taylor Giorno, 5 Senate Banking Dems demand more details on corporate lobbying strategy, The Hill (November 15, 2023), http://tinyurl.com/yc2b2eyx.

[28] Letter to The Honorable Gary Gensler, Chair, U.S. Securities Exchange Commission from U.S. Senators Elizabeth Warren, Sherrod Brown, Jon Tester, Tina Smith, and John Fetterman (November 15, 2024), http://tinyurl.com/48wzb25t.

[29] See Timothy Smith & John Keenan, Disclosing Corporate Lobbying, Harv. L. Sch. F. on Corp. Governance (Apr. 2, 2018), http://tinyurl.com/3889t4ss.

[30] Clara Hudson, Corporate Investors Target Labor, Political Spending in 2024, Bloomberg Law (December 22, 2023), http://tinyurl.com/2dkrcdtj.

[31] Ian Duncan, Luz Lazo, Michael Laris, Before Ohio derailment, Norfolk Southern lobbied against safety rules, Washington Post (February 18, 2023), http://tinyurl.com/23aszpen and TSC Industries, Inc. v. Northway, Inc., 426 U.S. 438, 450 (1976), http://tinyurl.com/4zsfn9jt.

[32] Pram Thakker, Norfolk Southern Has Thrown Roughly $100 Million Into Politics Since 1990, The New Republic (February 20, 2023), http://tinyurl.com/4hxc34xx and Norfolk Southern Annual Lobbying Totals: 1998-2023, OpenSecrets (viewed on January 26, 2024), http://tinyurl.com/3xrtj9rv.

[33] Public Citizen analysis of Norfolk Southern federal lobbying data for 2013-2022 from OpenSecrets (viewed on January 24, 2024), http://tinyurl.com/bdf2ck4z.

[34] Adam Lowenstein, ‘Crafting an illusion’: US rail firms’ multimillion-dollar PR push, The Guardian (February 27, 2023), http://tinyurl.com/usw8679e.

[35] Public Citizen analysis of Norfolk Southern federal lobbying data for 2023 from OpenSecrets (viewed on January 26, 2024), http://tinyurl.com/bdf2ck4z.

[36] Public Citizen analysis of Norfolk Southern federal lobbying data from OpenSecrets (viewed on January 26, 2024), http://tinyurl.com/3xrtj9rv.

[37] Public Citizen analysis of Norfolk Southern federal lobbying data from OpenSecrets (viewed on January 26, 2024), http://tinyurl.com/3xrtj9rv.

[38] Lobbyists representing Norfolk Southern, 2023, OpenSecrets (viewed on January 25, 2024), http://tinyurl.com/ujcxenhw.

[39] Lobbyist Profile: Trent Lott, OpenSecrets (viewed on January 24, 2024), http://tinyurl.com/3ev35u77.

[40] Lobbyist Profile: John Breaux, OpenSecrets (viewed on January 24, 2024), http://tinyurl.com/4fe49dxt.

[41] Lobbyist Profile: Patrick Meehan, OpenSecrets (viewed on January 24, 2024), http://tinyurl.com/mr33492b.

[42] Craig Holman, Public Citizen, Origins, Evolution and Structure of the Lobbying Disclosure Act (May 11, 2006), http://tinyurl.com/2epswa4p.

[43] Bills Lobbied By Norfolk Southern 2023, OpenSecrets (viewed on January 25, 2024), http://tinyurl.com/y85k3zx3 and Norfolk Southern Corporation Lobbying Report, Quarter 3, 2023, Dated October 20, 2023, http://tinyurl.com/5n8hjyfz.

[44] Issues Lobbied By Norfolk Southern 2023, OpenSecrets (viewed on January 25, 2024), http://tinyurl.com/4apen84p and http://tinyurl.com/34sn3wab.

[45] Nick Evans, Will Norfolk Southern’s political spending help shield it from consequences?, Ohio Capital Journal (March 2, 2023), http://tinyurl.com/39c998x4.

[46] Darrel Rowland, Norfolk Southern plied Ohio politicians with campaign cash, extensive lobbying, WSYX ABC-TV Channel 6 (February 20, 2023), http://tinyurl.com/mram2a29.

[47] Justin Sweitzer, Norfolk Southern has spent millions on lobbying and political donations. Will it pay off?, City & State Pennsylvania (April 3, 2023), http://tinyurl.com/3ufub92t.

[48] The Corporate State Lobbying Black Hole, Sustainable Investments Institute (December 2023), http://tinyurl.com/2p9k5ce7.

[49] Taylor Giorno, 5 Senate Banking Dems demand more details on corporate lobbying strategy, The Hill (November 15, 2023), http://tinyurl.com/yc2b2eyx.

[50] OpenSecrets analysis (accessed January 24, 2024), http://tinyurl.com/2f5zxaj9.

[51] Craig Holman, Public Citizen, Origins, Evolution and Structure of the Lobbying Disclosure Act (May 11, 2006), http://tinyurl.com/2epswa4p.

[52] 50 State Chart: Lobbyist Activity Report Requirements, National Conference of State Legislatures (May 15, 2018), https://www.ncsl.org/research/ethics/50-state-chart-lobbyist-report-requirements.aspx.

[53] See Timothy Smith & John Keenan, Disclosing Corporate Lobbying, Harv. L. Sch. F. on Corp. Governance (Apr. 2, 2018), http://tinyurl.com/3889t4ss.

[54] Id. (“According to the Conference Board, companies with a high reputation rank perform better financially than lower ranked companies, and executives find it is much harder to recover from a reputational failure than to build and maintain reputation. Without openness and transparency, corporate lobbying can be used to promote public policy objectives that can pose reputational risks.”)

[55] See TSC Industries, Inc. v. Northway, Inc., 426 U.S. 438 (1976).

[56] Letter to The Honorable Gary Gensler, Chair, U.S. Securities Exchange Commission from U.S. Senators Elizabeth Warren, Sherrod Brown, Jon Tester, Tina Smith, and John Fetterman (November 15, 2023), http://tinyurl.com/48wzb25t.

[57] Id.

[58] Id.

[59] The Corporate State Lobbying Black Hole, Sustainable Investments Institute (December 2023), p. 4, http://tinyurl.com/2p9k5ce7 and Timothy Smith & John Keenan, Disclosing Corporate Lobbying, Harv. L. Sch. F. on Corp. Governance (Apr. 2, 2018), http://tinyurl.com/3889t4ss.

[60] See Timothy Smith & John Keenan, Disclosing Corporate Lobbying, Harv. L. Sch. F. on Corp. Governance (Apr. 2, 2018), http://tinyurl.com/3889t4ss, see also Interfaith Center On Corporate Responsibility, https://www.iccr.org/corporate-lobbying/, and Corporate Reform Coalition, https://corporatereformcoalition.org/campaigns.

[61] Clara Hudson, Corporate Investors Target Labor, Political Spending in 2024, Bloomberg Law (December 22, 2023), http://tinyurl.com/2dkrcdtj.

[62] The Corporate State Lobbying Black Hole, Sustainable Investments Institute (December 2023), p. 7, http://tinyurl.com/2p9k5ce7.

[63] Id. p. 4.