Insurance Giant AIG Must Publicly Reject Insurance for Exploding Gas Terminal

Activists Rally in NYC to Demand AIG Meet Its Climate Commitments

By Rick Morris, Insurance Campaigner for Public Citizen

“Our home! Our home! Is not a sacrifice zone!”

“We’ve been fighting 5 LNG terminals and now we’re down to two!” Bekah Hinojosa of South Texas Environmental Justice Network shouted through the megaphone, giving hope to dozens rallying on a hot September afternoon outside of American International Group’s (AIG) NYC headquarters.

The activists gathered to demand that AIG stop insuring the Freeport Liquid Natural Gas (LNG) Terminal, which exploded in June of 2022, injuring beach goers and spewing out methane gas. AIG insures the terminal, despite its public pledges to climate leadership.

“My community relies on shrimping, on fishing, on a healthy ecosystem. Our communities cannot handle another explosive disaster like Freeport LNG” said Hinojosa.

The deadline for AIG to decide whether to renew its coverage of Freeport LNG passed at the end of September. Despite demands from impacted communities and AIG’s own climate commitments, the insurance giant refused to say that it would not renew its coverage.

Check out an audio documentary of the action by Sanctuary Radio and activists’ tweets from the day.

The AIG protest was part of a week of actions across NYC where activists pressured banks and insurers to stop funding the climate crisis. Without insurance coverage and financial support, developers cannot build fossil fuel infrastructure.

“AIG is directly responsible and complicit in the destruction of our communities,” echoed Alicé Nascimento of New York Communities for Change. “It has a responsibility. It can either continue insuring projects like the Freeport LNG . . . or it can usher us into a future of green solutions where we can all win.”

“But right now you’re killing us for profit. And that ain’t right!” Alicé ended, and the crowd echoed, “That ain’t right!”

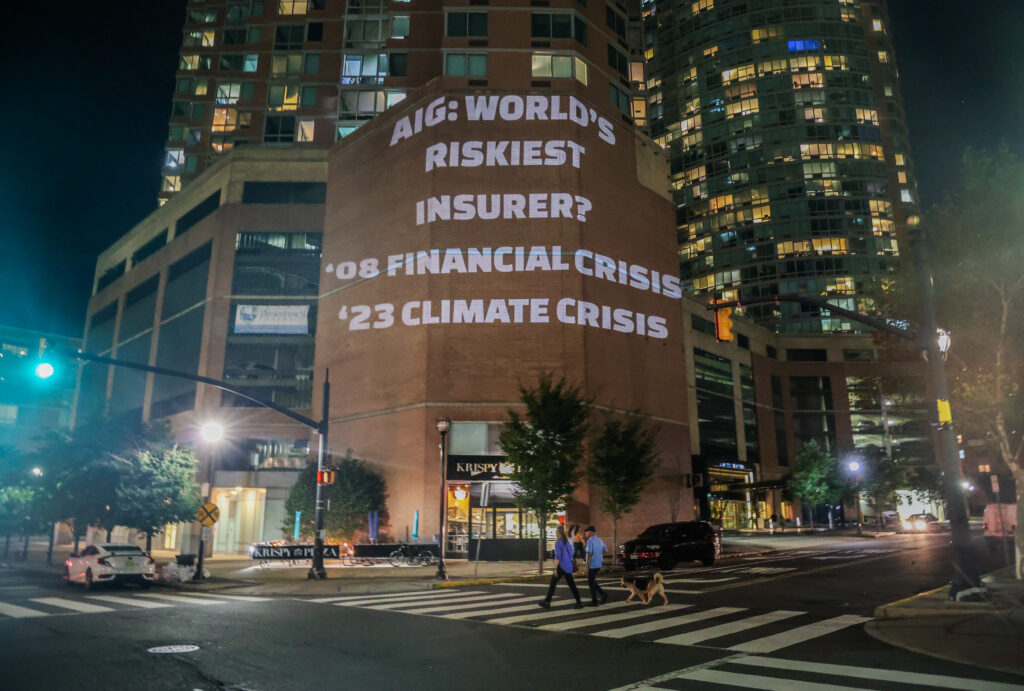

The protest occurred 15 years after the insurance giant nearly went bankrupt due to reckless financial practices, and the federal government bailed it out for $182 billion.

Today, AIG is still on the forefront of recklessness—one of the world’s biggest insurers of oil and gas, which is endangering the stability of our financial system, climate, and communities like Hinojosa’s on the Gulf Coast. That ain’t right.