Public Citizen Comments to Center for Medicare on Drug Price Negotiation Implementation

Public Citizen comments re initial drug price negotiation guidance

On March 15, 2023, the Center for Medicare released initial guidance for the first year of the new drug price negotiation program established under the Inflation Reduction Act, passed through Congress by congressional Democrats and signed by President Biden in August 2022, and solicited comments from stakeholders for the Center to consider as it finalizes the guidance.

Public Citizen filed the following comments on April 14, 2023:

Meena Seshamani, M.D., Ph.D

CMS Deputy Administrator and Director of the Center for Medicare

Transmitted via IRARebateandNegotiation@cms.hhs.gov

April 14, 2023

Public Citizen Comments Regarding Medicare Drug Price Negotiation Guidance

Dear Dr. Seshamani,

Thank you for the opportunity to provide stakeholder feedback as CMS works to enact the new drug price negotiation and inflationary rebate systems established through the Inflation Reduction Act.

Public Citizen is a nonprofit consumer advocacy organization with more than 500,000 members and supporters. The Access to Medicines program advocates for access to prescription drugs in the United States and internationally.

Public Citizen and health care access proponents across the nation invested tremendous energy into supporting Medicare drug price negotiation becoming law. We share CMS’ goal of making this program a success to help prevent prescription drug manufacturer price gouging of seniors and people with disabilities with Medicare, and taxpayers who support the program.

Below, we outline several comments and recommendations in response to CMS’ solicitation of stakeholder feedback on initial guidance regarding implementation of sections 11001 and 11002 of the Inflation Reduction Act (IRA) (P.L. 117-169).

In summary of our highest priority comments to this guidance:

1a) We strongly urge CMS against adopting a negotiation starting point using existing prices of therapeutic alternatives that have not been negotiated by Medicare, as doing so will lead to inappropriately high maximum fair prices for Medicare beneficiaries and taxpayers.

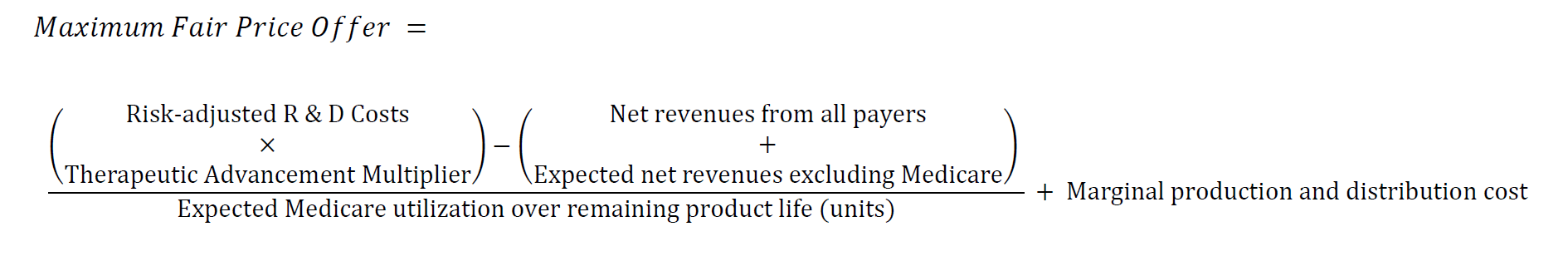

1b) Instead, we urge CMS to adopt a modified cost-plus approach, under which drug corporations are paid a fair portion of the revenue necessary to recover risk-adjusted R&D costs, accounting for therapeutic advancement, plus the marginal cost of production and distribution.

2) Retain CMS’ proposed approach of considering all dosage forms and strengths of a drug with the same active moiety as a qualifying single source drug. Doing so is vital to preserving program integrity and consistent with the intent of the legislation.

3) Provide greater transparency around R&D costs and other data. CMS’ overly expansive interpretation of what information shall be held confidential would severely limit the impact of the legislation on industry drug pricing practices and the ability of the public to assess whether the Medicare drug price negotiation program is successfully negotiating “the lowest maximum fair price for each selected drug”, as required under the Act, which would instill greater public confidence in the program.

Thank you again for this opportunity and for your consideration of these comments as CMS works towards implementing the Act.

Table of Contents

- Starting with the prices of therapeutic alternatives will lead to ongoing inappropriately high prices. 3

- Starting with the prices of therapeutic alternatives would be a missed opportunity for the law to provide virtuous systemic impact. 3

Suggested Formula for HHS to Arrive at Maximum Fair Price Offers: 4

- Risk-Adjusted Research and Development Costs, Accounting for Federal Investment 4

- Therapeutic Advance Multiplier 7

- Net and Expected Net Revenues. 8

- Marginal Production and Distribution Cost 9

- Note on Negotiation Delay Periods. 9

- Note on Consideration of Prices of Therapeutic Alternatives. 9

Additional Recommendations: 12

Recommendation 1a: Do not use the existing prices of therapeutic alternatives as the starting point for developing an initial price offer in drug price negotiations.

Section 60.3 outlines the proposed methodology from CMS for developing an initial price offer in drug price negotiations. CMS proposes in section 60.3.2 to take as a starting point for developing its initial negotiated price offer the average prices available for therapeutic alternatives for the selected drug.

Below, we articulate two major concerns with this approach.

I. Starting with the prices of therapeutic alternatives will lead to ongoing inappropriately high prices.

Evidence shows that drug prices paid under Medicare Part D are significantly higher than those paid under other health programs in the United States, including Medicaid and the Department of Veterans Affairs, as well as those paid in other wealthy countries.[1],[2],[3]

Current inappropriately high prices, which burden Medicare beneficiaries and taxpayers, are the underlying reason that Congress passed and President Biden signed a law to empower Medicare to negotiate in the first place.

These prices are set by drug corporations under monopoly conditions to maximize profits, while plans face broad coverage obligations under Medicare Part D. Taking prices of therapeutic alternatives set under these conditions as the starting point for developing negotiated price offers would in turn bias the system towards inappropriate high, unfair prices.

This would be inconsistent with the IRA requirement that CMS develops a methodology and process for drug price negotiation “that aims to achieve the lowest maximum fair price for each selected drug.”[4]

II. Starting with the prices of therapeutic alternatives would be a missed opportunity for the law to provide virtuous systemic impact.

In support of its negotiated price offer starting point proposal, CMS argues that “[the prices of therapeutic alternatives] is an important factor when considering the overall benefit that the treatment brings to Medicare beneficiaries.” We agree that pricing of a medicine and its therapeutic alternatives impact Medicare beneficiaries, but we do not believe it follows that prices of therapeutic alternatives should dictate the starting point of prices CMS negotiates.

Rather than provide virtuous systemic impact, the current process CMS is considering would reduce incentives for manufacturers of therapeutic alternatives to lower their prices. Using existing drug prices that have not been negotiated by CMS as the basis for negotiations risks building inertia for higher prices into the system. By instead negotiating a maximum fair price through alternate methods, such as those we propose below and other organizations have proposed separately, CMS’ negotiation process could help reduce the prices of the alternative therapies, since the manufacturers of the alternatives may try to compete on price with that of the negotiated product.

At the bottom of recommendation 1b below, we provide an alternative for how CMS may incorporate prices of therapeutic alternatives in its judgment of an appropriate maximum fair price offer, that does not have the vulnerabilities articulated above.

Recommendation 1b: Instead, to calculate a maximum fair price, take a modified cost-plus approach, under which drug corporations are paid a fair portion of the revenue necessary to recover risk-adjusted R&D costs, accounting for therapeutic advancement, plus the marginal cost of production and distribution.

When negotiating prices, CMS can deliver access and protect innovation by calculating the maximum fair price using the baseline of risk-adjusted research and development (R&D) costs.

Medicines are information goods. R&D costs—not other welfare metrics like “value”—should form the core basis for negotiating prices because R&D costs can help answer the inquiries central to information economics: how much does innovation cost, and how much compensation is necessary to induce innovation?

Exclusive rights allow prescription drug corporations to charge prices that are not linked to the cost of innovation. As one drug executive noted, “We all look at each other and keep pace with each other. Honestly, there is no science to it.”[5] Pharmaceutical industry pricing practices reduce social welfare by limiting access and create massive inefficiencies in the form of deadweight loss. Governments tolerate this static (short-term) inefficiency in the name of protecting dynamic (long-term) incentives for innovation. HHS can help challenge this false dichotomy by negotiating lower prices that appropriately reward true R&D costs.

The IRA lists a series of negotiating factors to help determine the maximum fair price offers and counteroffers. [6] To calculate the maximum fair price for a unit of drug for Medicare, CMS should take a modified cost-plus approach, under which drug corporations are paid a fair portion of the revenue necessary to recover risk-adjusted R&D costs, accounting for therapeutic advancement, plus the marginal cost of production and distribution. We explain each factor below.

Suggested Formula for HHS to Arrive at Maximum Fair Price Offers:

I. Risk-Adjusted Research and Development Costs, Accounting for Federal Investment

The cost of innovation should be central in determining the maximum fair price assessment. Unfortunately, section 60.3.4 shows that CMS intends to deprioritize manufacturer-specific data, which represent more than half of the total number of factors provided under statute for CMS to consider in determining its maximum fair price offers and counteroffers.[7] Section 60.3.4 of the guidance goes so far to suggest that CMS may not even incorporate consideration for this information in its maximum fair price offer. This would seem to represent a failure to meet the obligations set forth for the Secretary under statute, that “the Secretary shall consider the following factors, as applicable to the drug, as the basis for determining the offers and counteroffers under subsection (b) of the drug[.]”[8] The statute does not direct CMS to pick and choose which factors enumerated in statute it will consider.

Under the IRA, manufacturers are required to submit information “in a form and manner specified by the Secretary” that CMS requires to carry out the negotiation. To determine actual R&D costs, CMS can require granular information. Drawing on expert reviews[9] and prior legislative proposals[10], we recommend that total expenditures on R&D are itemized by direct and indirect costs, including for:

- Basic and preclinical research;

- Clinical research, reported separately for each clinical trial, per patient, per year, comprising

- Personnel costs (including salary and benefits)

- Administrative staff

- Clinical staff

- Materials and supplies

- Clinical procedures

- Site management

- Site monitoring costs

- Site retention

- Other

- Central laboratory

- Equipment

- Other direct costs

- Publication Costs

- Subawards/Consortium/Contractual Costs

- Other;

- Development of alternative delivery systems, dosage forms, strengths or combinations; and

- Other development activities, such as post-approval testing and record and report maintenance.

- Personnel costs (including salary and benefits)

In Appendix C of the guidance, CMS appropriately delineates a wide array of information that will be required to be disclosed by manufacturers, pursuant to section 1194(e)(1) of the IRA.[11] To the extent that any ambiguity remains, we recommend CMS clarify that this information, described under definitions relating to R&D costs in Appendix C, should be provided in an itemized and disaggregated fashion. This is particularly important with regard to reporting costs separately for each clinical trial, as there are significant differences in risk depending on trial phase, as described further below.

Obtaining disaggregated, detailed information offers two advantages over relying only on more generalized and potentially misleading research and development information disclosed pursuant to SEC requirements. First, CMS can risk-adjust R&D figures in a more sophisticated way, including by stage of clinical development, and better account for federal investment. For example, researchers have estimated success rates across clinical trials, including by drug class, disease and indication.[12] Together with the cost of trials and federal investment, CMS can use these figures to determine the cost of trial failures—and hence, risk-adjusted trial costs incurred by the manufacturer.

Table 1: Drug Development Success Rates (Hay et al., 2014)[13]

| Stage | Phase Success | Likelihood of Approval |

| Phase 1 to Phase 2 | 64.5% | 10.4% |

| Phase 2 to Phase 3 | 32.4% | 16.2% |

| Phase 3 to NDA/BLA | 60.1% | 50.0% |

| NDA/BLA to Approval | 83.2% | 83.2% |

Second, the granularity of R&D costs can increase the integrity of the data and help prevent gaming of R&D cost figures. Aggregate figures, like the ones reported by firms in financial filings, capture many different kinds of expenses that inflate the real cost of R&D, making them less useful. For example, firms can include the costs of acquiring a candidate as an R&D expense, even if the acquisition cost was based on the expected revenue the candidate could generate—not necessarily the money that was spent in research and development.[14] (In the case of a drug that was acquired part way through its development, it should be incumbent on drug corporations to disclose disaggregated information on actual R&D expenditures on the drug candidate prior to its acquisition to the extent they want such costs considered by CMS.) Successful drug development organizations, like the Drug for Neglected Diseases Initiative, have shown that reporting real R&D costs is possible, and provide crucial insights on how that reporting might be structured.[15]

Furthermore, a three-year House Oversight Committee investigation into drug pricing, initiated by the late Rep. Elijah E. Cummings, found that drug corporations can also include in bulk R&D figures “non-innovative R&D expenditures.” The Committee found that the corporations reviewed in their investigation “dedicated a significant portion of their R&D expenditures to research that was intended to extend market monopolies, support the companies’ marketing strategies, and otherwise suppress competition.”[16]

Under a pure cost-plus payment model, sellers may have a perverse incentive to inflate costs incurred and reported, knowing that higher costs will result in increased payment. If pharmaceutical reimbursement is linked to actual costs reported, then drug corporations could inflate expenditures, especially to the extent they are risk adjusted for payment considerations. CMS is well positioned to overcome this obstacle and better incent efficient drug development by using data-driven proxies for R&D and production and distribution costs.

Importantly, the law requires manufacturers to submit information regarding “[p]rior Federal financial support for novel therapeutic discovery and development with respect to the drug.” The extent to which R&D has been supported and subsidized by the Federal government and other public sources is a key factor in determining privately borne risk in developing a medicine. In addition to requiring companies to report and acknowledge all relevant public R&D contributions in all forms, HHS should work across government to gather such information and make it public.

In collaboration with U.S. Government entities that conduct and fund clinical trials, within HHS as well as elsewhere within the federal government, including the National Institutes of Health (NIH), the Biomedical Advanced Research and Development Authority (BARDA), the Centers for Disease Control and Prevention (CDC), the Food and Drug Administration, the Department of Defense, and the Department of Veteran Affairs, CMS can supplement manufacturer-provided information to develop an R&D cost database and form proxies using average costs of R&D for different categories of therapies, using representative samples of R&D costs for different products. HHS can then use the appropriate category of proxy of demonstrated R&D costs for calculating the maximum fair price offer of a given drug. Optimally, HHS would also obtain as much data as possible on costs of failed clinical trials to best inform its calculation of risk-adjusted R&D costs. HHS and other agencies taking action to increase and systematize compliance with the Stevens Amendment, which requires disclosure of the total costs of programs or projects paid for with federal funds “[w]hen issuing statements, press releases, requests for proposals, bid solicitations and other documents describing projects or programs,” can also provide greater insight into federal support for pharmaceutical R&D.[17]

Using the risk-adjusted, true R&D cost can help provide a fairer baseline from which to reward innovation. This can be adjusted to account for clinical benefit, as described in the following section.

II. Therapeutic Advance Multiplier

To promote meaningful innovation, manufacturers that produce drugs with new, clinically meaningful benefit should receive robust rewards, including the ability to make a reasonable profit on risk-adjusted R&D investments that they incur. Manufacturers of products that do not show evidence of improving health outcomes, relative to other therapies at the time of approval, should not be excessively rewarded. A therapeutic advancement multiplier (TAM) can be applied to the risk-adjusted R&D costs. The TAM can be based on the magnitude and certainty of evidence of net clinical benefit[18] compared to other therapies available at the time of approval, taking into account the factors enumerated in the IRA, including unmet medical needs.[19]

The value of the multiplier would be less than one if there is a lack of or only very weak evidence of increased value compared to other therapies at the time of FDA approval or licensure, and greater than one if there is clear evidence of increased therapeutic value relative to other available therapies for the conditions for which the drug is indicated. A similar categorization of therapeutic benefit is used in Germany.[20]

Table 2: Therapeutic Advancement Multiplier (TAM)

| Strength of Evidence | Added Value | ||

| Minor | Significant | Major | |

| Low-to-Moderate | potentially higher than 1 | probably higher than 1 | higher than 1 |

| High or Proof | higher than 1 | higher than 1 | highest possible multiplier |

| No Data | below 1 | below 1 | below 1 |

| High or Proof Against | lowest possible multiplier | below 1 | below 1 |

Multiplying the risk-adjusted R&D cost with the therapeutic advancement multiplier provides the size of the full reward the pharmaceutical manufacturer should obtain from the drug over the entire life of the product. The table above provides general guidance for determining the size of TAMs that will prevent inappropriately subsidizing corporations for medicines that lack evidence of improving health outcomes and allow for negotiated prices that reward genuine advancements. The appropriate TAM for a medicine with strong evidence of providing major added health benefit may be significantly higher than one, but should conform to the principle stated at the beginning of this section: how much does innovation cost, and how much compensation is necessary to induce innovation?

By ensuring that drug manufacturers are well rewarded for true, novel therapeutic advancements and, importantly, avoiding inappropriately subsidizing corporations through excessive prices paid by patients and taxpayers for products that are required by statute to be included in formularies but that do not show increased benefit relative to other therapies, IRA drug price negotiations can promote an R&D ecosystem better aligned with serving unmet health needs.

While we take strong exception to CMS’ proposed approach for reaching a starting point for a maximum fair price offer, discussed in recommendation 1a above, the approach CMS takes to analyzing comparative effectiveness between a selected drug and its therapeutic alternatives (described in section 60.3.3 of the guidance and its subsections) could be consistent with this element of our proposal in development of a Therapeutic Advancement Multiplier and its rationale.

III. Net and Expected Net Revenues

Determining Medicare’s fair share requires assessing how much additional reward the manufacturer needs to obtain the full appropriate reward during the remaining product life, taking into account the net and expected revenues from other payers. CMS can obtain information about how much the manufacturer has already recouped so far, estimate how much the manufacturer expects to make from other payers over the remaining product life, and then divide the difference over the expected product volume sold to Medicare over the remaining product life to determine a Medicare price. Because pharmaceutical corporations operate in a global marketplace and are not bound only to market products in the United States, global sales should be included in this calculation. The first factor for consideration for the purpose of negotiating the maximum fair price of a selected drug in the IRA includes “the extent to which the manufacturer has recouped research and development costs,” which necessarily implicates the extent to which such costs have been recouped through U.S. and non-U.S. sales.

IV. Marginal Production and Distribution Cost

Finally, beyond rewarding medical innovation, CMS should pay for the marginal cost of production and distribution for medicines used by Medicare beneficiaries. Using the marginal cost of production and distribution—rather than the average total—is the most precise way to determine minimum costs. It precludes the manufacturer from adding other costs into the figure.[21]

V. Note on Negotiation Delay Periods

While our proposed formula for CMS to calculate maximum fair price offers is constructed to arrive at appropriate prices consistent with promoting medicines access and innovation regardless of how long a product has been on the market, currently negotiations are permitted only for older medicines. Specifically, CMS is allowed to negotiate prices only for drugs and biologics that will have been on the market for at least 9 or 13 years by the time such prices take effect.

Since CMS will only be negotiating prices of high spend drugs and biologics for which drug corporations have had many years to recoup risk-adjusted R&D costs, and they will likely have done so many times over prior to the initial price applicability year, even with a very large therapeutic advancement multiplier, it may be appropriate for the maximum fair price offer from CMS to approach the marginal production and distribution cost per unit. CMS should not shy away from approaching marginal cost pricing of medicines that have been super-blockbusters, such as those that have already generated tens-of-billions of dollars in revenues since entering the market.

By applying this calculation to determine maximum fair price offers and counteroffers, CMS can create a predictable system for rewarding medical innovation and ensuring reasonable prices. Indeed, to preserve the integrity of the system, CMS should only adjust its response to a manufacturer counteroffer if refinements to the input data are presented. Consistent use of the calculation can help realign incentives for pharmaceutical corporations and promote more meaningful medical innovation.

VI. Note on Consideration of Prices of Therapeutic Alternatives

To the extent the CMS deems it necessary to consider prices of therapeutic alternatives in its determination of an appropriate maximum fair price offer, rather than the approach articulated in section 60.3.2 of the guidance, under which prices of therapeutic alternatives form the starting point for CMS’ negotiated price offer, CMS should instead take the approach we have articulated above, and as a final step in the process, compare the maximum fair price reached to the prices of therapeutic alternatives. The maximum fair price CMS plans to offer should be reduced to a price that is no higher than the lowest price of a therapeutic alternative that has demonstrated safety and efficacy matching that of the selected drug, including generic and biosimilar versions of therapeutic alternatives marketed in the United States, if the planned offer is not already below this price. A similar approach to internal, therapeutic reference pricing has been incorporated in Denmark’s pharmaceutical reimbursement regime since 2005.[22],[23]

Recommendation 2: Retain CMS’ proposed approach of considering all dosage forms and strengths of a drug with the same active moiety, inclusive of products marketed pursuant to different New Drug Applications (NDAs) and Biologics License Applications (BLAs), as a qualifying single source drug.

Section 30.1 of the initial negotiation guidance correctly cites section 1192(d)(3)(B) of the IRA, which requires CMS to aggregate sales across dosage forms and strengths of a qualifying single source drug in determining whether such drug is negotiation eligible.[24] Additionally, section 1192(b) of the IRA[25] requires CMS to select drugs for negotiation based on the rankings of total expenditures under Medicare Part D for negotiation-eligible drugs, as clarified under section 1192(d)(3)(B) to include spending “data that is aggregated across dosage forms and strengths of the drug, including new formulations of the drug, such as an extended release formulation, and not based on the specific formulation or package size or package type of the drug.”

This language clarifies the intent of policymakers of applying negotiated prices across dosage forms and strengths of a selected drug, which necessitates the approach CMS proposes in the guidance to take for identifying potential qualifying single source drugs.

Further, the approach proposed by CMS will prevent gaming and abuse of the Medicare drug price negotiation program that may occur if prescription drug corporations were able to prevent a high-revenue product from qualifying for negotiation through product hopping and obtaining new NDAs and BLAs, effectively resetting the clock on the statutory 7- and 11-year delay periods before a drug or biologic may qualify for negotiation.[26]

As CMS indicated in the guidance that section 30 is final as written, we appreciate that CMS will correctly move forward with this approach.

Recommendation 3: Provide greater transparency around R&D costs and other data to amplify the impact on industry pricing practices and instill public confidence in the Medicare drug price negotiation program.

Section 40.2.1 of the guidance indicates that “CMS intends to treat research and development costs and recoupment, unit costs of production and distribution, pending patent applications, and market data and revenue and sales volume data to be proprietary, unless the information that is provided to CMS is already publicly available, in which case it would be considered non-proprietary.”

This overly expansive interpretation of what information collected by CMS through the drug price negotiation program shall be held confidential would severely limit the impact of the legislation on industry drug pricing practices and the ability of the public to assess whether the Medicare drug price negotiation program is successfully negotiating “the lowest maximum fair price for each selected drug”, as required under the Act, which would instill greater public confidence in the program.[27]

CMS can achieve the lowest maximum fair price for drugs and amplify the impact of the IRA on industry pricing practices by collecting detailed, disaggregated figures around R&D costs, and openly publishing the data. CMS has a unique opportunity to examine the assumptions of the industry business model. Sunshine on this business model would further aid the public discourse and policymakers beyond CMS working to advance measures supporting access to medicines and innovation. Greater disclosure would also be consistent with the U.S.-supported World Health Assembly resolution WHA72.8, “Improving the transparency of markets for medicines, vaccines, and other health products.”[28]

As described above under recommendation 1b, CMS can collect an array of information about R&D costs under the IRA. Critically, IRA grants CMS authority to determine whether the submitted information is “proprietary” and hence subject to any disclosure limitations.[29] CMS is also required to publish “the explanation for the maximum fair price” with respect to the factors used to determine it, which include data about R&D costs, production costs, and patents and exclusivities.

The IRA provides no additional guidance on what information should be considered proprietary. CMS may be guided by trade secrets law. In federal statute, the Defend Trade Secrets Act defines the term “trade secret” as information that:

(A)the owner thereof has taken reasonable measures to keep such information secret; and

(B)the information derives independent economic value, actual or potential, from not being generally known to, and not being readily ascertainable through proper means by, another person who can obtain economic value from the disclosure or use of the information[.][30]

While detailed R&D costs may be kept “secret”, they may not hold independent economic value to others, especially years after the costs have accrued.[31] Historically, NIH has disclosed some cost data in response to Freedom of Information Act requesters, further suggesting such information is not considered by NIH to be trade secret or confidential commercial information.[32] CMS can also aggregate information on a case-by-case basis. Moreover, CMS can share even information that is considered trade secret if it does so under a license for noncompetitive purposes, or limits disclosure to a subset of recipients who are not competitors.[33]

By more critically scrutinizing whether the information it receives is proprietary, CMS can publish much of the data it collects as part of its explanation for pricing determinations. This can help inform the public debate about the benefits and limitations of the current industry business model and have a transformative impact beyond the IRA.[34]

Additional Recommendations:

- As CMS considers information submitted[35] on selected drugs and their therapeutic alternatives, critically scrutinize the quality of the evidence and weight it accordingly.

Well-designed randomized clinical trials with tight statistical confidence intervals confirming clinically meaningful safety and effectiveness should be weighted more heavily in CMS’ consideration than information from less rigorous sources.

- Proceed with CMS’ intended approach of “calculating recoupment of R&D costs using the global, total lifetime net revenue for the selected drug”, as stated in Appendix C of the guidance.

As stated under recommendation 1b, because pharmaceutical corporations operate in a global marketplace and are not bound only to market products in the United States, global sales should be included in this calculation. The first factor for consideration for the purpose of negotiating the maximum fair price of a selected drug in the IRA includes “the extent to which the manufacturer has recouped research and development costs,” which necessarily implicates the extent to which such costs have been recouped through U.S. and non-U.S. sales.

- We encourage CMS to adjust its price offer downward to the extent R&D costs have been recouped by a manufacturer and up to the extent they have not been recouped, as considered in section 60.3.4 of the guidance.

This recommendation comes with the caveats of criticisms provided under recommendation 1a and the strong encouragement towards taking the more comprehensive approach described in recommendation 1b. Our proposed formula for CMS to use in determining a maximum fair price would have this result.

- We recommend CMS clarify that the information described under definitions relating to R&D costs in Appendix C should be provided in an itemized and disaggregated fashion, to the extent the guidance leaves ambiguity on this point.[36]

This is particularly important with regard to reporting costs separately for each clinical trial, as there are significant differences in risk depending on trial phase, as described further in recommendation 1b.

- As CMS considers manufacturer-specific data provided under section 1194(e)(1) of the IRA, it must critically scrutinize the assumptions and calculations provided in manufacturers’ narrative texts.

Section 60.3.4 of the guidance indicates that CMS will use “the assumptions and calculations in the accompanying narrative text” submitted by the manufacturer in its consideration of this data. Manufacturers may make unrealistic assumptions about cost of capital and risk and otherwise seek to use this narrative to inflate the price implicated by the data it provides under section 1194(e)(1) of the Act. CMS must remain vigilant to prevent such mischaracterizations from leading to inappropriately high maximum fair prices.

- Take a more holistic approach to considering federal financial contributions to drug development, including with consideration for other forms of support, such as critical scientific contributions to underlying inventions, upstream research and funding thereof, and other support from public sector research institutions and publicly supported research programs.

The FY2023 NIH budget is approaching $50 billion dollars, the vast majority of which funds “extramural research through grants, contracts, and other awards to universities and other research institutions.”[37],[38] For decades, the NIH and the public have played an integral role in drug development and the NIH role in basic research is understood by many. Researchers recently found that “[o]verall, NIH funding contributed to research associated with every new drug approved from 2010-2019, totaling $187 billion.”[39]

While traditionally the NIH is understood to provide support for foundational basic research, increasingly, the public sector is providing more contributions later in drug discovery. A recent review of patents associated with all drugs having a new molecular entity approved by FDA over a 10-year period found that 19% of the drugs had origins in publicly supported research and development and 6% originated in companies spun off from a publicly supported research program.[40] An earlier study showed that over 40 years, 153 new FDA-approved drugs, vaccines, or new indications were discovered by public sector research institutions, more than half of which were used in the treatment or prevention of cancer or infectious diseases.[41] CMS should account for these vital public contributions as it develops maximum fair price offers.

Additionally, when pending and approved patent applications disclose U.S. government scientists as inventors, or it is the position of an agency of the U.S. Government that its scientists should be listed as coinventors,[42] this should be considered in-kind financial support and the maximum fair price offer from CMS should be adjusted downward to take account for this public support, which de-risks drug development.

- Do not use inflated value metrics for coupons, goods donated, or other forms of voluntary access concessions when calculating the global, total lifetime manufacturer net revenue for the selected drug.

Appendix C of the negotiation guidance indicates that CMS intends to consider coupons and donated goods in its “Global, Total Lifetime Manufacturer Net Revenue for the Selected Drug” definition. Manufacturers may seek to argue for aggressively high offsets to their revenues from such coupons and donations, such as the full list price that would have been paid for a donated product, or the difference between such price and a coupon price and the amount paid by an insurer. It would be more appropriate to understand such price concessions, including any provided through patient assistance programs, as voluntary. They should not be considered in the net revenue calculation.

If CMS declines to take this position, it should use the cost of goods donated and should not use a hypothetical price a party may have paid for the product absent such voluntary concession(s).

—–

Footnotes:

[1] Government Accountability Office, Prescription Drugs: Department of Veterans Affairs Paid About Half as Much as Medicare Part D for Selected Drugs in 2017, GAO-21-111, January 14, 2021.

[2] Mulcahy AW, C.; Tebeka, M.; Schwam, D.; Edenfield, N.; Becerra-Ornelas, A. International Prescription Drug Price Comparisons. 2021; https://www.rand.org/content/dam/rand/pubs/research_reports/RR2900/RR2956/RAND_RR2956.pdf. Accessed April 7, 2023.

[3] Government Accountability Office, Prescription Drugs: U.S. Prices for Selected Brand Drugs Were Higher on Average than Prices in Australia, Canada, and France, GAO-21-282, April 28, 2021.

[4] 42 U.S.C § 1320f–3 (b)(2).

[5] https://www.nytimes.com/2015/07/23/business/drug-companies-pushed-from-far-and-wide-to-explain-high-prices.html

[6] 42 USC § 1320f-3(e)(1) and 42 USC § 1320f-3(e)(2).

[7] 42 USC § 1320f-3(e)(1)

[8] 42 USC § 1320f-3(e)

[9] NYU Law, Clinical Trial Cost Transparency at the NIH: Law and Policy Recommendations (2020), https://www.law.nyu.edu/centers/engelberg/pubs/2020-08-17-Clinical-Trial-Cost-Transparency-at-the-NIH

[10] S.909 – Prescription Drug Price Relief Act of 2021, https://www.congress.gov/bill/117th-congress/senate-bill/909/text

[11] 42 USC § 1320f-3(e)(1)

[12] Michael Hay et al., Clinical development success rates for investigational drugs, 32 Nature Biotechnology (2014).

[13] Michael Hay et al., Clinical development success rates for investigational drugs, 32 Nature Biotechnology (2014).

[14] An analysis of 10-K filings by Knowledge Ecology International showed that pharmaceutical corporations sometimes include the costs of acquiring licenses and other assets as research costs. See https://www.keionline.org/wp-content/uploads/KEI-Written-Testimony-OR-SB793.pdf

[15] DNDI, Transparency of R&D Costs, https://dndi.org/advocacy/transparency-rd-costs/

[16] U.S. House of Representatives Committee on Oversight and Reform, Majority Staff Report: Drug Pricing Investigation, December 2021, https://oversight.house.gov/sites/democrats.oversight.house.gov/files/DRUG%20PRICING%20REPORT%20WITH%20APPENDIX%20v3.pdf

[17] Government Accountability Office, Grants Management: Agency Action Required to Ensure Grantees Identify Federal Contribution Amounts, March 2019, https://www.gao.gov/assets/gao-19-282.pdf

[18] Taking into consideration both potential benefits and risks.

[19] 42 USC § 1320f-3(e)(2).

[20] Skipka et al., Methodological approach to determine minor, considerable, and major treatment effects in the early benefit assessment of new drugs, https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5034755/

[21] CMS could also consider forming proxies with consideration of pricing information of generic drugs in the same category of therapy, where available, to avoid perverse incentives to inflate marginal costs of production and distribution to obtain higher prices.

[22] Ulrich Kaiser, Susan J. Méndez, Thomas RØnde, Hannes Ullrich. “Regulation of Pharmaceutical Prices: Evidence from a Reference Price Reform in Denmark.” February 2013. https://docs.iza.org/dp7248.pdf

[23] It is difficult to estimate the impacts of this policy in isolation strictly by looking at the Danish experience, as there are other significant differences in their pharmaceutical system from that of the United States, including operating under a universal health care system and an obligation for pharmacists to first offer a patient the lowest-price product within a group of substitutes for a drug unless prohibited by the prescription.

[24] 42 USC § 1320f-1(d)(3)(B)

[25] 42 USC § 1320f-1(b)

[26] 42 USC § 1320f-1(e)(1)(A)(ii) and 42 USC § 1320f-1(e)(1)(B)(ii)

[27] 42 USC § 1320f-3(b)(1)

[28] Seventy-Second World Health Assembly, WHA72.8, 28 May 2019, https://apps.who.int/gb/ebwha/pdf_files/WHA72/A72_R8-en.pdf

[29] 42 USC § 1320f–2 (c). (”Information submitted to the Secretary under this part by a manufacturer of a selected drug that is proprietary information of such manufacturer (as determined by the Secretary) shall be used only by the Secretary or disclosed to and used by the Comptroller General of the United States for purposes of carrying out this part.”)

[30] 18 USC § 1839

[31] Curbing Unfair Drug Prices, A Primer for States (2017), Yale Global Health Justice Partnership Policy Paper, https://law.yale.edu/sites/default/files/area/center/ghjp/documents/curbing_unfair_drug_prices-policy_paper-080717.pdf

[32] See NYU Law, Clinical Trial Cost Transparency at the NIH: Law and Policy Recommendations (2020), https://www.law.nyu.edu/centers/engelberg/pubs/2020-08-17-Clinical-Trial-Cost-Transparency-at-the-NIH at footnote 178

[33] See Amy Kapczynski, The Public History of Trade Secrets, UC Davis Law Review, Vol. 55, at 1438-1440 https://lawreview.law.ucdavis.edu/issues/55/3/articles/files/55-3_Kapczynski.pdf; See also Christopher J. Morten, Amy Kapczynski, The Big Data Regulator, Rebooted: Why and How the FDA Can and Should Disclose Confidential Data on Prescription Drugs and Vaccines, Columbia Law Review, Vol. 109:493, at 552-555, https://scholarship.law.columbia.edu/cgi/viewcontent.cgi?article=3814&context=faculty_scholarship

[34] See e.g., the Senate Finance Committee report on hepatitis C medicines and its impact.

[35] Section 50.2 of the guidance states that “[t]he Primary Manufacturer and members of the public, including other manufacturers, Medicare beneficiaries, academic experts, clinicians, and other interested parties, may submit information on selected drugs and their therapeutic alternatives […]”

[36] This a reiteration of a point included in recommendation 1b, to avoid it being lost in the wider-ranging recommendation above.

[37] Specifically, more than 84% of the FY2023 NIH budget goes towards these purposes.

[38] CRS Reports. National Institutes of Health (NIH) Funding: FY1996-FY2023, Updated March 8, 2023. https://sgp.fas.org/crs/misc/R43341.pdf

[39] Ekaterina Cleary, et. al. Government as the First Investor in Biopharmaceutical Innovation: Evidence From New Drug Approvals 2010–2019. Institute for New Economic Thinking Working Paper Series No. 133. https://doi.org/10.36687/inetwp133

[40] Rahul K Nayak, Jerry Avorn, Aaron S Kesselheim. “Public sector financial support for late stage discovery of new drugs in the United States: cohort study.” BMJ 2019; 367 doi: https://doi.org/10.1136/bmj.l5766 (Published 23 October 2019)

[41] Ashley J. Stevens, et. al., “The Public Role of Public-Sector Research in the Discovery of Drugs and Vaccines.” N Engl J Med 2011; 364:535-541. DOI: 10.1056/NEJMsa1008268 https://www.nejm.org/doi/full/10.1056/nejmsa1008268

[42] In a recent dispute with the biopharmaceutical corporation Moderna, the NIH correctly argued that as part of its four-year partnership with Moderna, NIH scientists coinvented the NIH-Moderna vaccine sequence. Moderna refused to name NIH scientists as coinventors and instead quietly abandoned these patents earlier this year. See Sheryl Gay Stolberg and Rebecca Robbins. “Moderna and U.S. at Odds Over Vaccine Patent Rights” New York Times. https://www.nytimes.com/2021/11/09/us/moderna-vaccine-patent.html and Public Citizen’s Letter on the Moderna Vaccine Patent Dispute https://www.nytimes.com/interactive/2021/11/09/us/public-citizen-nih-moderna-vaccine.html