Energy Subsidies: Myth and Facts

There is a lot of misinformation spreading around Texas right now about wind energy.

This summer, Texas set new records for energy demand, the product of millions of Texans running their air conditioning to beat the extreme heat. Earlier this year, several coal plants were retired, taking hundreds of megawatts of power off the grid and raising the question whether Texas’ energy supply could meet demand. The grid responded well, and Texans have not faced energy shortages, price spikes, or reliability issues. (You already know this. Did you experience blackouts? Did your bills spike?)

But lobbyists from the fossil fuel industry have taken this opportunity to spread misinformation about the role of wind and other renewable energy sources. They have claimed, for example, that wind energy is detrimental because the wind blows the most at night, when demand is low. (This is nonsense. Energy demand never drops to zero, and Texas is able to use the energy produced by wind at all hours of the day.)

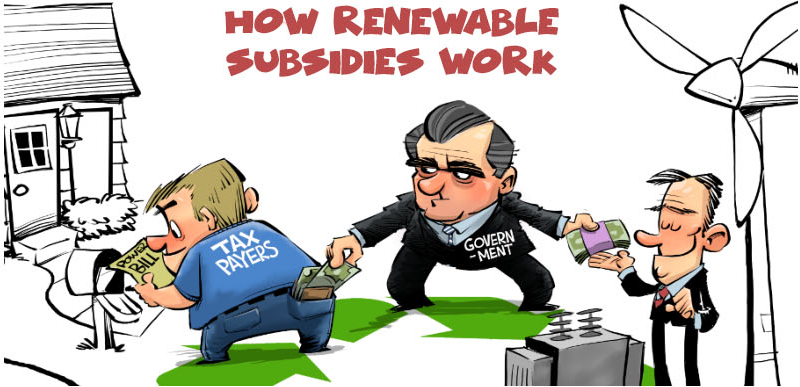

We have also been told that renewable energy subsidies are disrupting energy markets, forcing sources like coal out of business. If you are a 19th century energy tycoon, you think of the situation something like this:

It is true that coal is having trouble competing, but that has nothing to do with energy subsidies and everything to do with Texas’ competitive energy market. Simply put: where wind is more affordable than coal, coal can’t compete and is priced out of the market.

That’s a good thing. We’ve replaced a dirty, fossil source of fuel with a clean, renewable source, and we’ve saved consumers money. That is a robust energy market at work.

But what about energy subsidies? We’re told that wind can only compete because it is propped up by government handouts. Is that true?

It is true that wind receives subsidies, but every source of energy receives subsidies, and always has. Subsidies for coal, oil, and natural gas have been in place for decades. The list of subsidies that have been available over the years is overwhelming: https://www.stopthesubsidies.com/.

In Texas, the fossil lobby’s ire over subsidies is directed at Chapter 313 of the Tax Code, the Texas Economic Development Act.

Chapter 313 was created in 2001 to incentivize large industrial projects by allowing school districts to lower property taxes for up to ten years. The theory behind Chapter 313 is that lower taxes will attract investment that would otherwise go elsewhere. From its creation through 2015, Chapter 313 has incentivized more than $81 billion in investment. Out of 311 approved projects, 144 were for wind energy and 22 were for other non-wind renewable energy projects. Oil and gas projects are lumped into a category of “manufacturing” projects that has included 139 projects over the years. Chapter 313 has also been used twice for nuclear projects and four times for research and development projects. At present, Chapter 313 is set to expire in 2022. Public Citizen supports Chapter 313 and believes that it should be continued by the state legislature. (We would like to thank Vanessa Tutos and Sarah Greenberg with EDPR for their research on Chapter 313. Greenberg, S. (2018) Chapter 313 Research Summary. Internal EDPR report. Unpublished.)

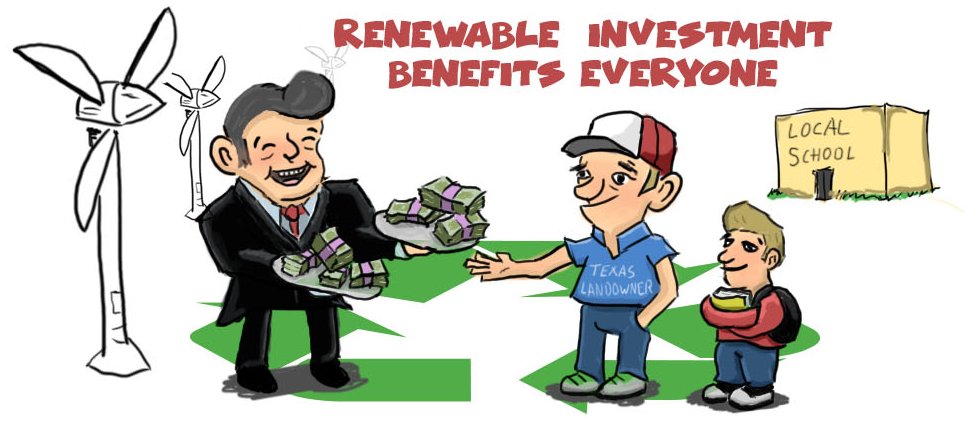

Here’s the thing about Chapter 313: it’s a tax break. Tax breaks are tried and true economic incentives. If you lower taxes, you incentivize investment. That’s a position long held by fiscal conservatives. If we were drawing our own version of the cartoon above (and guess what? we did!) it would look something like this:

Chapter 313 isn’t taking money out of anyone’s pocket. It is providing school districts with a way to incentivize economic investment within their borders. If a school district attracts a wind energy project (or any project) with a Chapter 313 incentive, then it increases its tax base and gets more money for its schools. There are small school districts in West Texas that have built entire schools with revenues from Chapter 313 projects.

So why are the fossil lobbyists so opposed to Chapter 313? Before we answer that question, here’s another surprising fact about Chapter 313.

It’s been used by the oil and gas industry nearly twice as much as by the wind industry.

From the beginning of the program in 2001 through 2015, oil and gas companies have received $3,244,574,036 in tax breaks from Chapter 313. Wind companies have received $1,563,876,000.

So don’t believe the fossil lobby when they talk about Chapter 313 as a “renewable subsidy.” It’s benefited the oil and gas industry more than twice as much as the wind industry. And if Chapter 313 tax abatements are ended, Texas communities and schools could miss out on the economic support brought by these wind projects, while all Texas residents could miss out on having more affordable electricity.

The fossil tycoons are scared. They can’t compete in the 21st century energy economy. They are lashing out with big-money lobby campaigns and misinformation. If they are successful, they could set the transition to renewable energy back several years. But they can’t stop the inevitable: clean, affordable energy for all Texans.