Pay-to-Play on Display: 19 of the 30 Companies With the Most Complaints in the CFPB Database Contributed to Mick Mulvaney

Mulvaney, Now Acting CFPB Director, Threatens to Hide Complaints From the Public

By Mike Tanglis

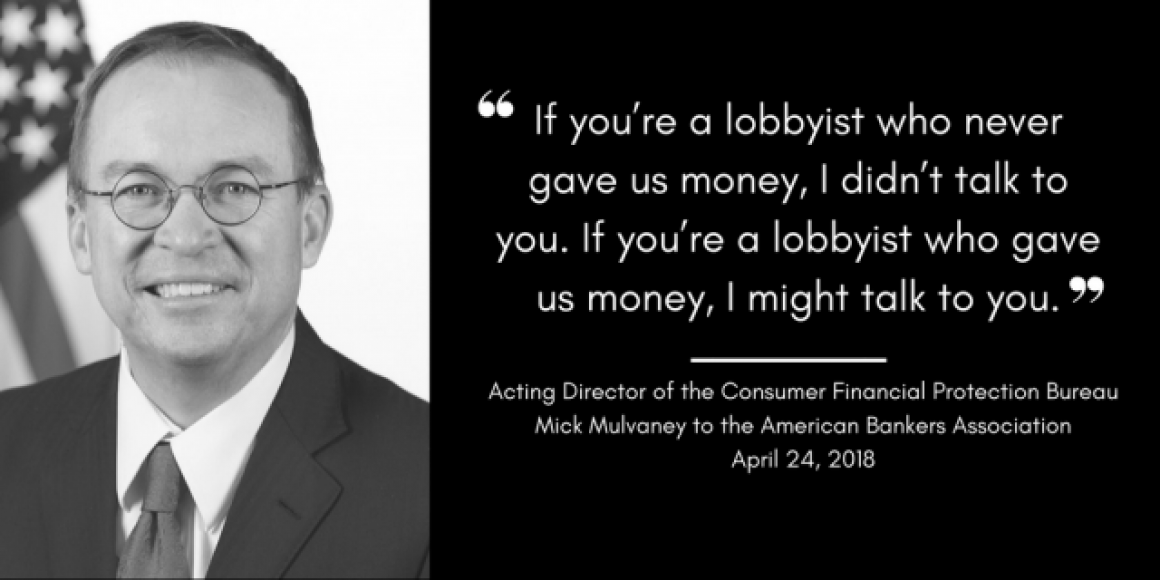

May 8, 2018 – In a speech to the American Bankers Association, acting Consumer Financial Protection Bureau Director Mick Mulvaney revealed how he operated in his recent career as a U.S. congressman.

“We had a hierarchy in my office in Congress,” Mulvaney said. “If you’re a lobbyist who never gave us money, I didn’t talk to you. If you’re a lobbyist who gave us money, I might talk to you.”

In the same speech, Mulvaney suggested he was considering shutting down the CFPB public facing database, launched 2012, which tracks complaints against members of the financial industry. “I don’t see anything in here that says I have to run a Yelp for financial services sponsored by the federal government,” Mulvaney said. “I don’t see anything in here that says that I have to make all of those public.”

Public Citizen examined the 30 companies subject to the most complaints in the CFPB database, as well as the thousands of political contributions Mulvaney received between his election to Congress in 2010 and his departure in early 2017. We found that 19 of the 30 companies subject to the most complaints, including eight of the top 10, contributed to Mulvaney via their political action committees. The contributions from the 19 totaled $140,500.

[Download a PDF of the full report]

The 19 Mulvaney contributors were subject to more than 520,000 complaints since the CFPB began accepting complaints in 2011. Complaints concerning them account for 51 percent of all complaints submitted to the database.

Equifax, the company that allowed hackers to gain access to the private information of 143 million Americans in 2017 and then waited six weeks to inform them, was subject to the most complaints – a staggering 83,000. [See Table 1 at bottom] Even though Equifax was involved in one of the most highly publicized scandals in recent years, 70 percent of the complaints against it were submitted prior to the September 2017 revelation of the data breach.

Most of the Organizations that Lobbied on the CFPB Database Contributed to Mulvaney

Public Citizen also analyzed which organizations have lobbied on the CFPB’s database. We found that 11 businesses or trade associations have reported lobbying on the CFPB database. Six of the 11 organizations contributed to Mulvaney.

Six of the lobbying entities were trade associations and therefore would not be the subjects of CFPB complaints. Of the five businesses, four were among the 30 companies subject to the most CFPB complaints.

Many of the trade associations’ members also were likely in the top 30. While many trade associations do not disclose their members, contributions to the associations’ PACs provide some insight. The Consumer Bankers Association PAC, for example, has reported receiving contributions from PACs of 14 the 30 institutions subject to the most complaints. These 14 contributed close to $450,000 to the Consumer Bankers Association PAC from 2009 through 2017 – accounting for 36 percent of all the contributions taken in by the PAC. These included HSBC, which did not contribute directly to Mulvaney, but did contribute $22,500 to the Consumer Bankers Association PAC from 2009 through 2017.

Another trade association that lobbied on the database, the Consumer Data Industry Association, counts among its members the three largest credit rating companies – Equifax, Experian and TransUnion. These companies were subject to the 1st, 3rd and 4th most complaints in the CFPB database.

Most of the lobbying organizations reported that they lobbied on the general issue of the CFPB consumer complaint database. But some reported lobbying on a specific piece of legislation that would have gutted the database. That legislation, H.R. 5941, would have required the CFPB to investigate every complaint before it published it.

Mulvaney was the author and sole sponsor of the bill.

Three of the four organizations that reported lobbing on Mulvaney’s bill also contributed to him. They included Consumer Bankers Association (which contributed $3,000 to Mulvaney), Credit Union National Association ($30,000) and Equifax ($5,000). [Table 2 at bottom]

Equifax – Wins the Pay-To-Play Triple Crown

In 2014, the CFPB proposed that consumer complaint narratives should be published. (At that point, the public facing database did not include consumer complaint narratives). Equifax lobbied on this issue in every quarter of 2015.

In 2016, Equifax lobbied both the U.S. House of Representatives and the CFPB on the consumer complaint database. Its 2016 advocacy included lobbying on the “CFPB’s Consumer complaint database” and H.R. 5491, the bill sponsored by Mulvaney.

When Mulvaney introduced the bill, Equifax had already contributed $5,000 to his campaign. While lobbying data does not allow one to know if Equifax met directly with Mulvaney’s office, we know that Equifax specifically lobbied the U.S. House on Mulvaney’s H.R. 5491, which had no cosponsors.

In 2017, Equifax continued to lobby the CFPB about its consumer complaint database, but unlike on past disclosures, it indicated it also lobbied the Office of Management and Budget on the CFPB’s consumer complaint database. By then, Mulvaney was the director of the OMB, a job he still holds, in conjunction with his CFPB duties.

Equifax is the lone company with the distinction of being among the 30 companies subject to the most complaints, lobbying on Mulvaney’s bill to gut the database, and contributing to Mulvaney.

In that way, it could be said that Equifax is this year’s winner of the pay-to-play Triple Crown.

Just this week, Equifax’s shareholders voted on a proposal to require the company to improve its disclosure of its efforts to influence elections, including indirect spending that can evade transparency laws. Its board, not surprisingly, recommended against the measure.

Cajoling politicians into doing favors, such as shutting down a database of consumer complaints, might yield short-term benefits. But that cannot hide fundamental flaws like the data breach that caused Equifax’s stock price to plummet by 35 percent, reducing the company’s value by nearly $6 billion.

Equifax would be well-served to hold its political spending up to shareholder and public scrutiny. It should focus on keeping the public’s data secret, not its political activities.

Table 1: 30 Companies Subject to the Most Complaints in the CFPB Database

| Company | Number of Complaints | PAC Contributed to Mulvaney | PAC Contributions to Mulvaney |

|---|---|---|---|

| Equifax Inc. | 83,252 | Yes | $5,000 |

| Bank of America, National Association | 74,221 | Yes | $19,000 |

| Experian Information Solutions Inc. | 72,188 | Yes | $6,000 |

| TransUnion Intermediate Holdings Inc. | 65,721 | ||

| Wells Fargo & Company | 62,142 | Yes | $12,000 |

| JP Morgan Chase & Co. | 51,139 | Yes | $10,500 |

| Citibank N.A. | 41,598 | Yes | $19,000 |

| Capital One Financial Corporation | 26,822 | Yes | $9,000 |

| Ocwen Loan Servicing LLC | 26,270 | ||

| Navient Solutions LLC | 24,243 | Yes | $2,000 |

| Nationstar Mortgage | 18,513 | ||

| Synchrony Financial | 17,084 | ||

| U.S. Bancorp | 14,727 | Yes | $5,000 |

| Ditech Financial LLC | 12,916 | ||

| American Express Company | 10,717 | Yes | $4,500 |

| PNC Bank N.A. | 10,082 | Yes | $10,500 |

| Encore Capital Group Inc. | 9,583 | Yes | $1,000 |

| Discover Bank | 8,315 | Yes | $7,500 |

| HSBC North America Holdings Inc. | 7,811 | ||

| Td Bank Us Holding Company | 7,788 | Yes | $5,000 |

| Portfolio Recovery Associates Inc. | 7,605 | ||

| SunTrust Banks Inc. | 7,397 | Yes | $12,500 |

| Select Portfolio Servicing Inc. | 7,061 | ||

| AES/PHEAA | 6,264 | ||

| Barclays Bank Delaware | 5,549 | ||

| ERC | 5,300 | ||

| Citizens Financial Group Inc. | 4,850 | Yes | $1,000 |

| Ally Financial Inc. | 4,495 | Yes | $2,000 |

| Fifth Third Financial Corporation | 4,441 | Yes | $2,500 |

| United Services Automobile Association | 4,294 | Yes | $6,500 |

| Total (of those who contributed only) | 522,294 | -- | $140,500 |

Table 2: Industry Organizations That Lobbied On CFPB Complaints Database, 2014 to 2018

| Client Name* | Lobbied on CFPB Database | Lobbied on H.R. 5941 | PAC Contributed to Mulvaney | Org. Is Among Top 30 in Complaints Submitted |

|---|---|---|---|---|

| Alticor Inc. | Yes | Yes | ||

| American Express Company | Yes | Yes | Yes | |

| Chamber Of Commerce of the USA | Yes | Does not apply | ||

| Consumer Bankers Association | Yes | Yes | Yes | Does not apply |

| Consumer Data Industry Association | Yes | Does not apply | ||

| Consumer Mortgage Coalition | Yes | Does not apply | ||

| Credit Union National Association | Yes | Yes | Yes | Does not apply |

| Equifax Inc. | Yes | Yes | Yes | Yes |

| Fifth Third Bancorp | Yes | Yes | Yes | |

| National Assoc. of Federally Insured Credit Unions | Yes | Yes | Does not apply | |

| Synchrony Financial | Yes | Yes |