Why We Need the Inclusive Prosperity Act

"It is Wall Street’s turn to help rebuild the American middle class."

By Lane Hagar

When the reckless and greedy practices of Wall Street financial institutions brought the economy crashing down in 2008, it was the American middle class that bailed them out. Wall Street is not only surviving now; it is thriving after costing Americans over 19 trillion dollars. Meanwhile, real working wages for the American middle class have only minimally increased!

The Inclusive Prosperity Act of 2019 will address the injustices created by the global financial crisis of 2008. As Sen. Bernie Sanders (I-Vt.) stated at the bill’s introduction:

“The middle class bailed out Wall Street in 2008, now it is Wall Street’s turn to help rebuild the American middle class.” – Senator Bernie Sanders

The Inclusive Prosperity Act proposes a modest tax of 0.5% on transactions involving stocks, 0.1% on bonds, and 0.005% on derivatives. Though miniscule, these taxes will stack up to a projected $2.2 trillion in revenue over ten years.

There is a great deal of precedent for a tax of this nature. In fact, from 1914 to 1966, a version of this tax existed in the United States and the U.S. currently has a very tiny fee on trades that funds the Securities and Exchange Commission. Additionally, more than 40 other countries including Britain, France, Germany, and South Korea have implemented a tax on financial trades. It is supported by several noteworthy billionaires such as Bill Gates, Warren Buffett, and Mark Cuban. More than 1,000 economists, several financial regulators, and past members of both Republican and Democratic presidents’ staff support a tax of this kind. And, the Democratic party national platform calls for a tax on Wall Street trades.

The Inclusive Prosperity Act will also strengthen the market by reducing the volume of high-frequency trades. These trades are made in a matter of milli-seconds and are oftentimes the result of receiving faster information that allows high-speed traders to engage in arbitrage that increases costs for other traders. The speed of trading can lead to “flash-crashes” that can sink the market quickly. For example, in May of 2010, high-frequency trading worsened a market scare and stocks fell 1,000 points in minutes. Thus, a tiny tax on speculative trading can minimize this high-frequency trading that exacerbates market disruptions while increasing faith in the market.

The revenue generated by the Inclusive Prosperity Act could pay for countless needed government reforms such as:

- Free college education/reduced student loan debt;

- Infrastructure repairs;

- Initiatives to combat climate change;

- Expanded benefits for Medicare, Medicaid, and Social Security;

- Global health crises such as HIV/AIDS; and

- Expanded resources for childcare

Opponents of the Inclusive Prosperity Act will argue that it unnecessarily hurts the ordinary American citizen trying to save for retirement. On the contrary, the Wall Street trading fee proposed is quite progressive and will mostly affect those individuals of greater means since they hold the vast majority of stock wealth. Furthermore, the bill provides for an income tax credit to those individuals making less than $50,000 a year and those joint couples making less than $75,000. Finally, the costs imposed by these new taxes are a small fraction compared to those already imposed by the financial institutions managing Americans’ mutual funds or brokers’ commissions.

Please contact your Senators and Representative and tell them to co-sponsor the Inclusive Prosperity Act!

Watch the livestream recording of the introduction of the Inclusive Prosperity Act:

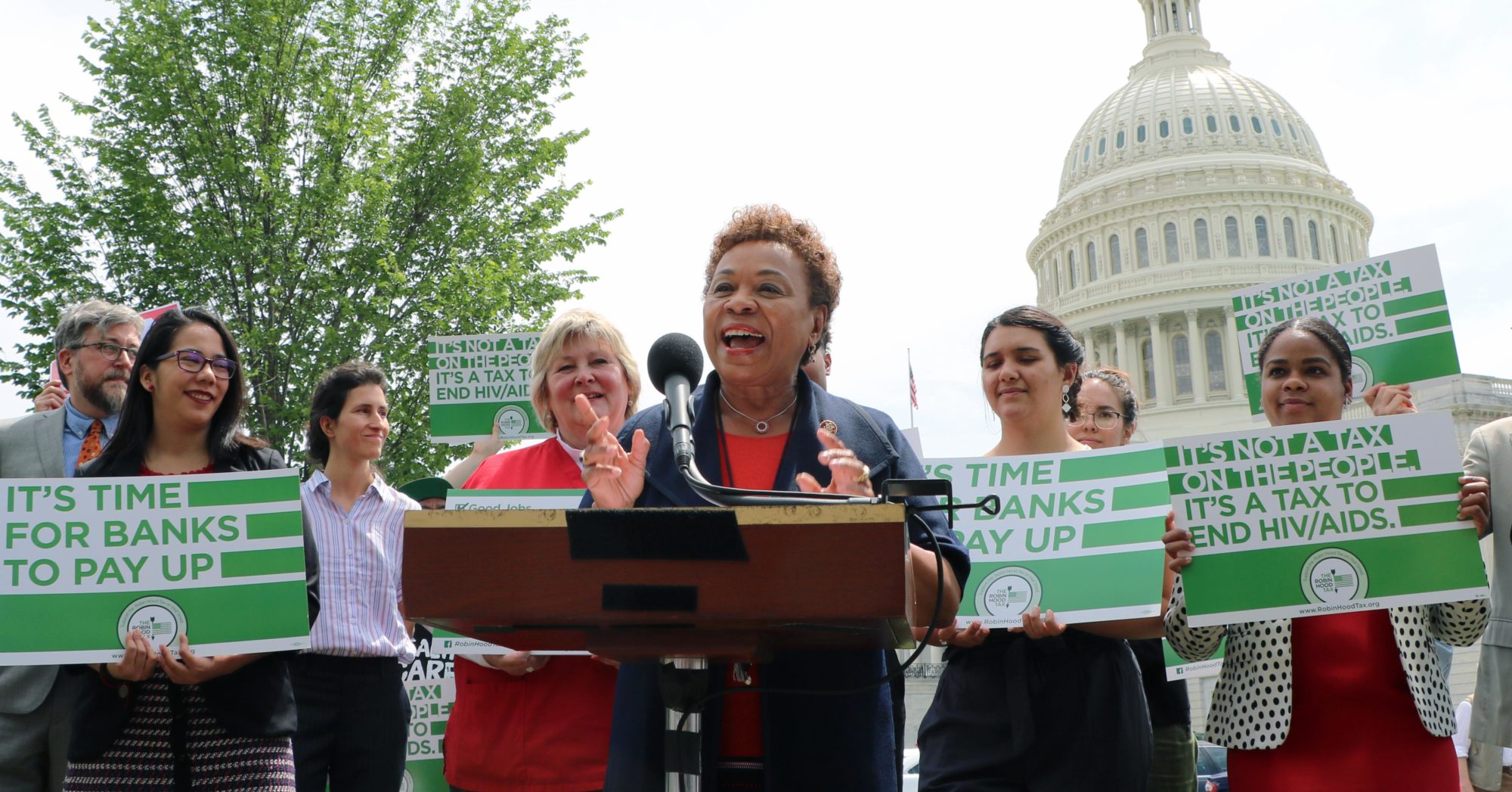

Photo credit: Office of Congresswoman Barbara Lee