Cracking Open the Shell of Anonymous Corporations

By Lane Hagar

Imagine a situation in which two people are walking down a street. One wants to rent a book from the local library. The other wants to form a business. Which act requires sharing more personal information? Forming a business, right?

Wrong.

The truth is, in all 50 states and the District of Columbia, less information is required to incorporate a company than to procure a library card. In fact, the person creating a company need not be the person who will own or control it, nor is there a requirement to disclose who that “beneficial owner” will be. There are firms that set up companies for other people routinely, charging only a few hundred dollars for the job, and jurisdictions like Delaware that market themselves as a good place to set up a secret company.

This lack of required ownership disclosure allows individuals to use these anonymous (“shell”) corporations to hide actions they don’t want linked to them. Corporations can do many of the same things a person can, like open a bank account, or buy and transfer assets. Unsurprisingly, shell companies make for an attractive vessel for criminals to carry out crimes like tax evasion, money laundering, and facilitating corruption.

While some argue that shell corporations are a necessary instrument to protect wealthy individuals from unwanted media attention or threats to personal safety, the reality is they are also used by some of the world’s most notorious criminals and illegal organizations to carry out their nefarious deeds. Shell companies have been used to help with arms agreements between North Korea and Iran, as well as illegal activities by the Sinaloa drug cartel. A shell company linked to Viktor Bout, the infamous “merchant of death”, provided the Taliban with arms. Dictators and rogue governments routinely use shell companies to hide their assets and avoid government sanctions.

These shell companies are perfectly legal in the United States and allow these criminal activities to continue unabated since law enforcement hit a brick wall when they encounter an anonymous corporation when following a money trail. This must stop.

As a solution, Representative Carolyn Maloney (D-NY) introduced the Corporate Transparency Act. This bill calls for the United States to implement beneficial ownership disclosure requirements when incorporating a company that align with international standards put forward by the Financial Action Task Force on Money Laundering. Applicants for a new business would be required to supply legal name, birthdate, and current residential or business address of the company’s beneficial owners—or, the natural persons who own, control or receive substantial economic benefit from the company. Furthermore, the application would require the number of a non-expired United States passport, identification card, or state-issued driver’s license of the beneficial owner(s).

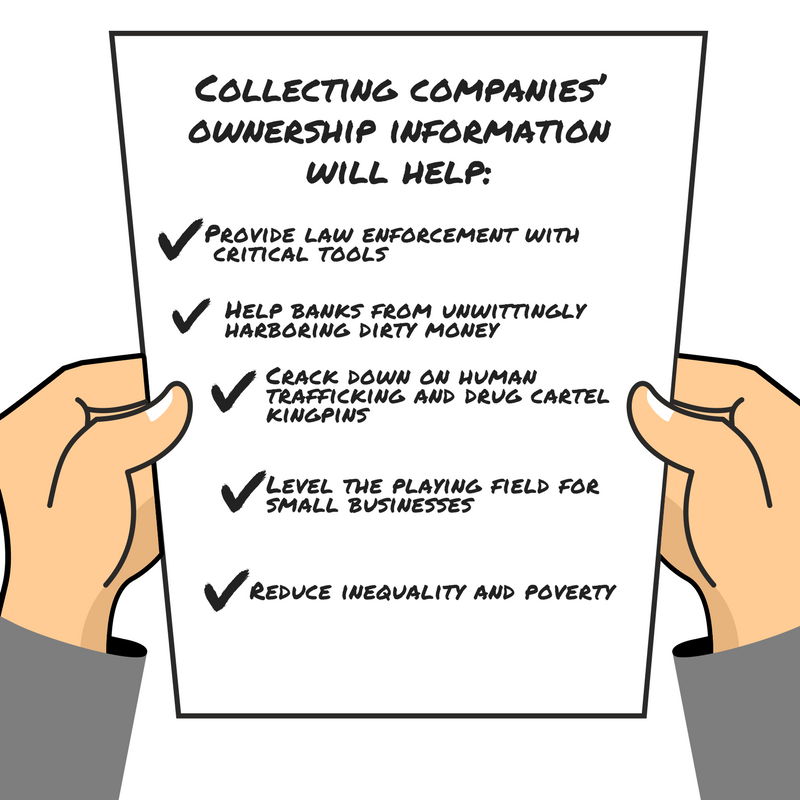

Requiring companies to list their owners at the time that they are formed will strengthen “law enforcement’s ability to investigate corporations and limited liability companies suspected of committing crimes.” It will also bring the United States in line with several other countries that have adopted such requirements for forming a business.

Yesterday, the U.S. House Financial Services Committee took a huge step forward toward ending secret companies in the United States by passing the Corporate Transparency Act with a vote of 43-16 including 10 Republican votes. In the Senate, a bipartisan “Group of Four” senators from the Banking Committee recently introduced a proposal to tackle this problem, and several additional Senate bills have been floated as well. So, the path forward to enacting a beneficial ownership policy in this Congress looks very likely.

But we can’t win unless Congress hears from YOU! NOW is the time to help crack the problem of shell companies by contacting your U.S. Representative and telling him or her to support the Corporate Transparency Act!