Deleting Tech Enforcement

Trump 2.0 Is Dropping Lawsuits and Investigations Against the $1 Billion-Spending Technology Sector

Key Findings

The Trump administration is punching the delete button on federal enforcement against lawbreaking by Big Tech corporations. Parroting President Trump’s complaints about “weaponized” government, tech executives cast commonsense protections for consumers, investors, and the public as unfair political attacks. Their goal: to derail enforcement by federal agencies charged with protecting Americans from their misconduct. It’s working.

In six months, the Trump administration has already withdrawn or halted enforcement actions against 165 corporations of all types – and one in four of the corporations benefiting from halted or dropped enforcement is from the technology sector, which has spent $1.2 billion on political influence during and since the 2024 elections.

Public Citizen’s analysis found that:

- The Trump administration has halted or withdrawn one third of targeted investigations into suspected misconduct and enforcement actions against technology corporations.

- At least 104 technology sector corporations faced at least 142 federal investigations and enforcement actions at the beginning of Trump’s second term.

- So far, 47 enforcement actions (against 45 tech corporations) have been withdrawn or halted (38 withdrawn, nine halted).

- These tech corporations, along with their executives and investors, collectively spent $1.2 billion on political influence during and since the 2024 elections, including:

- $863 million in political spending;

- $222 million in payments to Trump’s businesses;

- $76 million in lobbying spending; and

- $25 million in donations to Trump’s inauguration.

- Two-thirds of the political spending – $610 million – was spent backing Republicans, including Trump. More than half of the political spending ($352 million) is attributable to Elon Musk.

- Nearly half of the enforcement actions that have been dropped or halted – 23 – were against cryptocurrency corporations (20 withdrawn, three halted).

- Financial technology (FinTech) corporations, mostly facing enforcement by the Consumer Financial Protection Bureau, also disproportionately benefitted, with eleven withdrawn or halted enforcement actions (seven withdrawn, four halted).

- Tech corporations that faced federal investigations and lawsuits under Biden that are poised to exploit their ties with the Trump administration include Amazon, Google, Meta, OpenAI, and corporations headed by Elon Musk (Tesla, SpaceX, xAI, The Boring Company, and Neuralink).

Note: The existence of investigations and/or allegations of misconduct do not necessarily mean that any laws were broken, or that an enforcement action necessarily would have been brought under a different administration.

The database of enforcement actions against tech corporations with links to underlying sources is available here. The full searchable database of corporate investigations and links to underlying sources is available through Public Citizen’s Corporate Enforcement Tracker.

Introduction

President Donald Trump spent much of his 2024 presidential campaign claiming his prosecution by multiple authorities and subsequent conviction for his crimes are unfair “weaponization” of law enforcement.

Corporate executives in the technology sector, eager to curry favor, seized on the talking point. They similarly cast powerful corporations accused of violating laws that protect consumers, workers, investors, and the public as victims of “weaponized” enforcement.

- Elon Musk, facing allegations of misconduct related to his purchase of Twitter, complained, “the SEC is just another weaponized institution doing political dirty work.”

- Venture capitalists Marc Andreessen and Ben Horowitz complain in a 2024 post that “big companies can weaponize the government against startups.”

- Brad Garlinghouse, CEO of the cryptocurrency corporation Ripple said the SEC in a post online “has essentially weaponized the lack of regulatory clarity through enforcement actions.”

- Coinbase CEO Brian Armstrong told CNBC that Biden enforcement agencies “weaponize the lack of clarity in the rules.”

- When Project 2025 architect and the administration’s most zealous anti-regulation ideologue Russ Vought dismissed the Consumer Financial Protection Bureau’s case against fintech corporation Solo Funds, he defended the dismissal with the claim, “the weaponization of ‘consumer protection’ must end.”

- Trump himself told crypto enthusiasts on the campaign trail, “Sadly, we see the attacks on crypto. It’s a part of a much larger pattern that’s being carried out by the same left-wing fascists to weaponize government against any threat to their power. They’ve done it to me.”

When Trump took office, the corporate campaign to discredit law enforcement that protects the public and holds the powerful accountable culminated in the day one executive order “Ending Weaponization of the Federal Government,” which explicitly ties enforcement against Trump and January 6 rioters to enforcement against corporate lawbreaking.

The executive order directed Attorney General Pam Bondi to “review the activities of all departments and agencies exercising civil or criminal enforcement authority of the United States, including, but not limited to, the Department of Justice, the Securities and Exchange Commission, and the Federal Trade Commission” under the Biden administration.

Since then, the Trump White House has exerted unprecedented authority over statutorily independent enforcement agencies such as the Consumer Product Safety Commission, Federal Trade Commission, and the Securities and Exchange Commission, and has essentially eliminated the half-century policy of the Justice Department’s independence from the White House.

The elimination of agency independence means enforcement investigations and lawsuits will not proceed if President Trump wants to kill them, and that agency officials who resist White House orders will be removed.

So far, the Trump administration’s efforts to dismantle federal enforcement against corporate lawbreakers have resulted in at least 165 cases against alleged corporate lawbreaking being halted or dropped.

Technology corporations, with their 47 dropped or halted cases so far, have disproportionately benefited from the administration’s attacks on enforcement against corporate lawbreaking (see Tables 1 and 2).

Table 1: Nine enforcement Actions Against Technology Corporations Halted by the Trump Administration

| Corporation | Industry | Agency | Status | Subject of Investigation or Allegation | Trump Admin Ties |

|---|---|---|---|---|---|

| Binance | Crypto | DOJ | 2023 plea deal requires a three-year corporate monitor; Trump’s DOJ has narrowed the use of corporate monitorships, and Binance has sought to have its monitors removed. | Binance pleaded guilty in 2023 to violations related to the Bank Secrecy Act, failure to register as a money transmitting business, and the International Emergency Economic Powers Act | Trump's family is reportedly in talks to purchase a stake in Binance's US subsidiary and to launch, through Trump's World Liberty Financial, a stablecoin on Binance's exchange. |

| Greenlight Financial Technology | FinTech | CFPB | Investigation reported; CFPB investigations and cases were frozen on 2/3/25. | Allegations that the company wasn’t allowing users immediate access to their money as it had advertised that it would, leaving some unable to pay for purchases | Backed by Andreessen Horowitz, the VC firm co-founded by Trump ally Marc Andreessen |

| GreenSky | FinTech | CFPB | Investigation reported; CFPB investigations and cases were frozen on 2/3/25. | For allegedly backsliding into misconduct similar to previously settled allegations | |

| KuCoin | Crypto | CFTC | Stayed; a CFTC attorney referenced the new chair's policy ending "regulation by enforcement" in a letter explaining its postponement of the KuCoin settlement. | Multiple violations of the Commodity Exchange Act and CFTC regulations | |

| Meta | Big Tech, Social Media | CFPB | Civil investigation reported; CFPB investigations and cases were frozen on 2/3/25. | Allegations of improperly using financial data obtained from third parties in its highly-lucrative advertising business | Meta donated $1 million toward Trump's inaugural fund. Trump ally Marc Andreessen is a member of Meta's board of directors. Rick Dearborn, who lobbied for Meta in 2024, worked on Trump's 2016 transition team and in the White House, and authored a section of Project 2025. David Sacks, Trump’s "AI & Crypto Czar," made a "notable investment" in the company. |

| PayPal | Big Tech, FinTech | CFPB | Investigation disclosed; CFPB investigations and cases were frozen on 2/3/25. | Investigation and error-resolution obligations under the Electronic Fund Transfer Act (Regulation E), the presentment of transactions to linked bank accounts, and related matters | PayPal donated $250,000 to Trump's inaugural fund. Several former PayPal executives and investors who constitute the "PayPal Mafia" are particularly influential in the Trump administration. |

| Point | FinTech | CFPB | Investigation reported; CFPB investigations and cases were frozen on 2/3/25. | Unspecified | |

| Tesla | Big Tech | DOL | Investigation reported; a Trump Executive Order halted anti-discrimination enforcement by the Labor Dept.’s Office of Federal Contract Compliance Programs. OFCCP staff informed Tesla that its investigation stopped. | Potential workplace discrimination | CEO is Elon Musk, who spent more than $290 million to help elect Trump and who led DOGE. Musk gave $50 million to Trump-backing super PACs in the first half of 2025. |

| Tron Foundation Limited, BitTorrent Foundation, Rainberry | Crypto | SEC, DOJ | Stayed; Trump's SEC and Sun filed a joint request to pause the litigation | Fraud and others securities law violations | CEO Justin Sun spent $193.6 million on Trump crypto ventures World Liberty Financial and the $TRUMP “meme coin.” |

Source: Analysis of Public Citizen’s Corporate Enforcement Tracker

Table 2: Thirty-eight enforcement Actions Against Technology Corporations Dismissed or Withdrawn by the Trump Administration

| Corporation | Industry | Agency | Status | Subject of Investigation or Allegation | Trump Admin Ties |

|---|---|---|---|---|---|

| ABB | Technology | DOJ | Corporate leniency agreement terminated early | Violations of the Foreign Corrupt Practices Act stemming from the bribery of a high-ranking official at South Africa’s state-owned energy company | |

| ACTIVE Network | FinTech | CFPB | Dismissed | Tricking people trying to sign up for fundraising road races and other events, into enrolling into its annual subscription discount club. | |

| Activision | Technology | FTC | Dismissed | Anticompetitive Microsoft-Activision merger sought | |

| Binance | Crypto | SEC | Dismissed | Thirteen charges, including operating unregistered national securities exchanges, broker-dealers, and clearing agencies | Trump's family is in talks to purchase a stake in Binance's US subsidiary and to launch, through Trump's World Liberty Financial, a stablecoin on Binance's exchange. |

| BitMEX | Crypto | DOJ | Pardoned | The corporate entity underlying BitMEX, HDR Global Trading Limited, pled guilty in July 2024 to violating the Bank Secrecy Act. The corporation was sentenced to two years of probation and fined $100 million. Four BitMEX founders and top executives also pled guilty to violating the BSA, and were pardoned by Trump. | |

| Branch Messenger (and Walmart) | FinTech | CFPB | Dismissed | For forcing delivery drivers to use costly deposit accounts to get paid and for deceiving workers about how to access their earnings | |

| Cognizant | Big Tech | DOJ | Received declination in 2019. Trump's DOJ dismissed the case against executives. | Alleged FCPA violations in India | Cognizant donated $50,000 to Trump's inaugural fund |

| Coinbase | Crypto | SEC | Dismissed | Charged with operating its crypto asset trading platform as an unregistered national securities exchange, broker, and clearing agency. The SEC also charged Coinbase for failing to register the offer and sale of its crypto asset staking-as-a-service program. | Coinbase donated $1 million toward Trump's inaugural fund. Coinbase hired the Trump campaign's 2024 co-manager, Chris LaCivita, as an advisor. |

| Consensys | Crypto | SEC | Dismissed | Charged with engaging in the unregistered offer and sale of securities through a service it calls MetaMask Staking and with operating as an unregistered broker | Consensys donated $100,000 to Trump's inaugural fund |

| Crypto.com (Foris Dax) | Crypto | SEC | Investigation closed | Allegedly trading unregistered securities | Crypto.com donated $1 million to Trump's inauguration and $10 million to MAGA Inc, a Trump-backing super PAC, under its business name, Foris Dax $TRUMP meme coins are traded on Crypto.com's platform Crypto.com is reportedly partnering with Trump Media to launch ETFs |

| Cumberland DRW | Crypto | SEC | Dismissed | Charged with operating as an unregistered dealer in more than $2 billion of crypto assets offered and sold as securities | The month after Trump's SEC dismissed its case, Cumberland founder Don Wilson bought $100 million worth of shares in Trump Media & Technology Group to help the Trump business invest in cryptocurrency |

| Early Warning Services | FinTech | CFPB | Dismissed | Alleged misconduct related to Zelle Network banks not doing enough to reimburse customers who were defrauded by scammers using the network | |

| eBay | Ecommerce | EPA, DOJ | Dismissed | Alleged eBay is liable for sales of products banned by EPA; invocation of Section 230 preceded dismissal | eBay hired Miller Strategies, a lobbying firm founded by Trump Inauguration finance chair Jeff Miller, to lobby federal agencies and Congress. |

| Gemini | Crypto | SEC | Investigation closed | For the unregistered offer and sale of securities to retail investors through the Gemini Earn crypto asset lending program | Twin brothers Cameron and Tyler Winklevoss, who together founded and run Gemini, contributed a $2.65 million to groups backing Trump for president in 2024. In the first half of 2025, the Winklevoss twins gave $1 million to MAGA Inc., a Trump-backing super PAC. |

| Hewlett Packard Enterprise | Big Tech | DOJ | Settled, merger permitted with divestitures | Anticompetitive Hewlett Packard Enterprise-Juniper Networks merger sought | HPE donated $250,000 to Trump's 2024 inaugural fund. HPE hired Trump administration allies Mike Davis and Arthur Schwartz to advocate for the merger |

| HireArt | AI | DOL | Investigation closed | Related to investigation into Scale AI's compliance with the Fair Labor Standards Act | |

| Horizen Labs | Crypto | SEC | Investigation closed | Related to the launch of ApeCoin cryptocurrency | |

| Immutable Labs | Crypto | SEC | Investigation dropped | Listing and private sales practices of cryptocurrency | |

| Juniper Networks | Technology | DOJ | Settled, merger permitted with divestitures | Anticompetitive Hewlett Packard Enterprise-Juniper Networks merger sought | HPE donated $250,000 to Trump's 2024 inaugural fund. HPE hired Trump administration allies Mike Davis and Arthur Schwartz to advocate for the merger |

| Kalshi | Crypto | CFTC | Dismissed | The CFTC determined in 2023 that Kalshi's proposed contracts involve gaming and activity that is unlawful under state law and are contrary to the public interest, and so are prohibited and cannot be listed or made available for clearing or trading on or through Kalshi | Trump named former Kalshi board member Brian Quintenz to serve as CFTC chair Kalshi named Donald Trump Jr. as a strategic advisor in January |

| Kraken (Payward) | Crypto | SEC | Dismissed | Charged with operating crypto trading platform as an unregistered securities exchange, broker, dealer, and clearing agency. | Kraken co-founder Jesse Powell donated $1 million in cryptocurrency backing Trump for president. Kraken donated $1 million toward Trump's inaugural fund. |

| Microsoft | Big Tech | FTC | Dismissed | Anticompetitive Microsoft-Activision merger sought | Microsoft donated $750,000 toward Trump's inaugural fund. |

| Nikola Corporation | Technology | DOJ | CEO pardoned | CEO Trevor Milton was sentenced in 2023 to four years in prison for engaging in securities and wire fraud in connection with his scheme to defraud and mislead investors about the development of products and technology by the company he founded, Nikola Corporation. | Milton and his wife donated more than $1.8 million to a Trump reelection campaign fund. Milton also was represented by Brad Bondi, brother of Attorney General Pam Bondi, and Marc Mukasey, who has represented Trump’s private business. |

| OpenSea | Crypto | SEC | Dismissed | Alleged sale of unregistered securities | Trump NFTs are bought and sold on OpenSea's platform |

| PayPal | Big Tech, FinTech | SEC | Investigation closed | PayPal's PYUSD stablecoin | PayPal donated $250,000 to Trump's inaugural fund. Several former PayPal executives and investors who constitute the "PayPal Mafia" are particularly influential in the Trump administration |

| Polymarket | Crypto | CFTC | Investigation closed | Misconduct connected with betting on US elections | Polymarket CEO Shayne Coplan was invited to attend a crypto summit at the White House on 3/7/25 |

| DOJ | Investigation closed | Misconduct connected with betting on US elections | Polymarket CEO Shayne Coplan was invited to attend a crypto summit at the White House on 3/7/25 | ||

| Ripple | Crypto | SEC | Appeal withdrawn, penalties reduced | Securities law violations | Ripple donated $4.9 million worth of its cryptocurrency to Trump's inaugural fund. Ripple Chief Legal Officer Stuart Alderoty donated $300,000 in cryptocurrency to back Trump for president. Ripple hired Trump ally Brian Ballard to lobby the administration on crypto issues. Trump chief of staff Susie Wiles is a former lobbyist with Ballard's firm. Ripple also retains Reince Priebus as a lobbyist, Trump's chief of staff during his first term as president. |

| Robinhood Markets | Crypto | SEC | Dismissed | Securities violations within crypto unit | Robinhood donated $2 million toward Trump's 2024 inaugural fund. Robinhood hired Trump ally Brian Ballard to lobby on crypto issues in 2024. Trump chief of staff Susie Wiles is a former lobbyist with Ballard's firm. |

| Rocket Companies (Rocket Homes) | FinTech | CFPB | Dismissed | Providing kickbacks to real estate brokers and agents to steer prospective borrowers to Rocket Mortgage | |

| Scale AI | AI | DOL | Investigation closed | Compliance with the Fair Labor Standards Act, specifically unpaid wages, misclassification, and retaliation | ScaleAI donated $125,000 to Trump's inaugural fund. Trump nominated former Scale AI executive Michael Kratsios to be director of the White House’s Office of Science and Technology Policy |

| Snap Finance | FinTech | CFPB | Dismissed | For deceiving consumers, obscuring the terms of its financing agreements, and making false threats | |

| Solo Funds | FinTech | CFPB | Dismissed | For deceiving borrowers about the total cost of loans | |

| SpaceX | Big Tech | DOJ Civil Rights | Dismissed | Accuses SpaceX of discriminating against asylees and refugees in hiring decisions | CEO is Elon Musk, who spent more than $290 million to help elect Trump and who led DOGE. Musk gave $50 million to Trump-backing super PACs in the first half of 2025. David Sacks, who Trump appointed to be the White House "AI & Crypto Czar," made a "notable investment" in the company according to the Craft Ventures website. SpaceX employs Miller Strategies, a lobbying firm founded by Trump Inauguration finance chair Jeff Miller. |

| Tornado Cash | Crypto | OFAC | Economic sanctions lifted | Allegedly used to launder more than $7 billion worth of virtual currency since its creation in 2019, including over $455 million for a North Korean state-sponsored hacking group. | |

| Uniswap Labs | Crypto | SEC | Investigation closed | Allegedly acting as an unregistered securities broker and unregistered securities exchange | Uniswap CEO Hayden Adams donated $245,000 to Trump's inaugural fund |

| Upwork | AI | DOL | Investigation closed | Related to investigation into Scale AI's compliance with the Fair Labor Standards Act | |

| Yuga Labs | Crypto | SEC | Investigation closed | Into whether the company behind Bored Ape Yacht Club NFTs violated laws prohibiting sale of unregistered securities. | Yuga Labs donated $100,000 to Trump's inaugural fund |

Source: Analysis of Public Citizen’s Corporate Enforcement Tracker

Big Tech Insiders Using Trump to Gut Enforcement

On day one of Trump 2.0, Big Tech billionaires and CEOs lined up with Trump and his cabinet members for the president’s inauguration ceremony. The photo op was the culmination of outreach from Big Tech executives to Trump that started before the election. Each of the tech oligarchs represented a corporate lawbreaker facing multiple federal enforcement actions – enforcement actions that Trump now has the authority to withdraw, dismiss, or weaken (see Table 3).

Table 3: Big Tech Executives at Trump’s Inauguration and Federal Enforcement Their Corporations Face

| Inauguration Attendee | Corporation | Enforcement Agency | Subject of Investigation or Allegation | Status |

|---|---|---|---|---|

| Jeff Bezos | Amazon | CPSC | Sales of unsafe recalled products | Civil litigation ongoing, Amazon contesting |

| DOJ | An alleged fraudulent scheme to conceal warehouse worker injuries from OSHA | Under investigation | ||

| EEOC | Discrimination against pregnant workers | Under investigation | ||

| FCC | Investigating sales of illegal wireless frequency jammers | Under investigation | ||

| FTC | Enrolling consumers into its Prime program without their consent while knowingly making it difficult to cancel subscriptions | Civil suit filed, trial set for June 2025 | ||

| Acting as a monopolist among e-commerce superstores and fulfillment providers | Antitrust suit filed | |||

| NLRB | Over 300 open cases alleging unfair labor practices and covering up to 1.6 million employees | Cases open. Amazon arguing for dismissal, contesting NLRB's constitutionality. | ||

| Tim Cook | Apple | DOJ | Smartphone market monopoly violations | Antitrust suit filed |

| EPA | Allegedly misclassifying hazardous waste and more than a dozen other “potential violations” of environmental regulations | Under investigation | ||

| NLRB | Over 20 open cases alleging unfair labor practices and covering up to 160,000 employees | Cases open | ||

| Shou Zi Chew | ByteDance (Tiktok) | DOJ, FTC | For violations of the Children’s Online Privacy Protection Act | Civil suit filed |

| NLRB | Three open cases alleging unfair labor practices and covering up to 150,000 employees | Cases open | ||

| Sundar Pichai | DOJ | Monopoly violations in advertising | Judge ruled Google violated Sections 1 and 2 of the Sherman Act | |

| Monopoly violations in search | Trump's DOJ dropped part of proposed breakup plan requiring Google to sell off AI businesses. | |||

| NLRB | Over 20 open cases alleging unfair labor practices and covering up to 180,000 employees | Cases open | ||

| Mark Zuckerberg | Meta | CFPB | Allegations that it improperly used financial data from third parties for its highly-profitable advertising business | Trump's CFPB ordered a freeze on all investigations and cases on 2/3/25. |

| FTC | Social media monopoly violations | Antitrust litigation ongoing | ||

| NLRB | Two open cases alleging unfair labor practices and covering up to 65,000 employees | Cases open | ||

| Sam Altman | OpenAI | FTC | Consumer harms from data collection and misinformation | Under investigation |

| SEC | Investigating internal communications to understand if investors were misled | Under investigation | ||

| Dara Khosrowshahi | Uber | FTC | Allegedly signing users up for its Uber One subscription service without notice and making it hard to cancel | Investigation initiated under Biden, proposed settlement reportedly opposed by Uber. FTC lawsuit filed on 4/21/25 |

| Whether Uber Technologies Inc. and Lyft Inc. illegally coordinated to limit driver pay in New York City. | Under investigation |

Source: Analysis of Public Citizen’s Corporate Enforcement Tracker

Elon Musk is the CEO who attended the inauguration whose businesses face the most federal enforcement actions – at least 19 separate sets of allegations from at least nine federal agencies (see Table 4).

Musk, of course, did not just attend the inauguration. As the richest person in the world, he spent $290 million of his personal wealth helping elect Trump to the presidency and subsequently served the Trump White House through May as a special government employee leading the aggressively destructive (and ironically inefficient) “Department Of Government Efficiency.”

“There are at least half a dozen initiatives of significance to take me down,” Musk wrote in a text message to a close ally in 2024, apparently referencing the many federal enforcement actions facing his business empire, according to the New York Times. “The Biden administration views me as the #2 threat after Trump. […] I can’t be president, but I can help Trump defeat Biden and I will.”

Often, DOGE self-servingly targeted agencies responsible for protecting the public from corporate lawbreaking, claiming to be reducing “waste” and attacking “fraud” while in fact sabotaging enforcement against Musk’s private businesses interests.

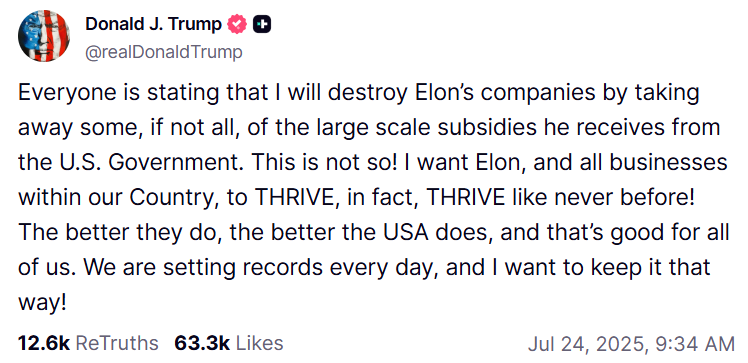

The on-and-off feuding between Musk and Trump since Musk’s departure from DOGE introduces fresh uncertainty into what will come of the investigations and enforcement lawsuits against Musk’s corporations. The Trump administration initiated a review of SpaceX’s federal contracts in apparent retaliation for Musk’s criticism of the Trump-backed spending bill and accusations of Trump’s ties with the late billionaire and convicted sex offender Jeffrey Epstein.

Trump subsequently posted on Truth Social, the MAGA social network company owned by the president’s family, that he will not take away federal contracts from Musk’s companies.

Nevertheless, how the Trump administration will resolve its enforcement actions against Musk’s businesses remains uncertain.

Campaign finance disclosures show Musk in the first half of 2025 gave $45 million to his Trump-backing America PAC and in late June gave $5 million to MAGA Inc., a separate Trump-backing super PAC, plus $5 million each to two super PACs dedicated to electing Republicans.

Table 4: Federal Investigations and Enforcement Lawsuits Against Corporations Led by Elon Musk

| Corporation | Enforcement Agency | Subject of Investigation or Allegation |

|---|---|---|

| Boring Company | OSHA | Eight serious violations |

| Neuralink | SEC | Unspecified |

| USDA | Alleged misconduct related to the mistreatment of test monkeys. | |

| SpaceX | DOJ | Accuses SpaceX of discriminating against asylees and refugees in hiring decisions |

| NLRB | NLRB complaint alleges SpaceX illegally fired workers who signed onto a letter publicly criticizing Musk, whose behavior the signers say has harmed the company’s reputation. Ten open NLRB cases covering 9,500 employees are currently open. | |

| OSHA | Three serious violations | |

| Tesla | DOJ | Over exaggerated claims about the “Full Self-Driving” capability of Tesla vehicles’ “Autopilot” mode may constitute criminal fraud, among other concerns. |

| DOJ, SEC | Into Tesla plans to construct a “glass house” in Texas as a home for Musk. | |

| DOL | Potential workplace discrimination | |

| EEOC | Racial discrimination and workplace retaliation at a California factory where Black workers allege being subjected to racial slurs and other severe or pervasive racial harassment | |

| EPA | Allegedly lying to government regulators about environmental violations | |

| NHTSA | One into reports of power steering losses in certain vehicle models, one into alleged inadequacies to updates intended to address safety problems with Autopilot software, one into the use of smartphone apps allowing vehicles to be controlled remotely | |

| NLRB | Seven open cases alleging unfair labor practices and covering up to 140,474 employees | |

| OSHA | 26 violations at multiple facilities resulting in citations and fines on a range of issues related to serious, and sometimes repeated, workplace injuries | |

| Workplace death of employee at Austin, Texas factory | ||

| SEC | Investigation into whether exaggerated claims about the self-driving capabilities of Tesla vehicles deceived investors | |

| X (formerly Twitter) | NLRB | Alleged unfair labor practices |

| SEC | Misconduct related to Musk’s $44 billion takeover of Twitter, now X. | |

| xAI | EPA | "EPA is aware of concerns that have been raised about air quality and regulatory applicability regarding the xAI facility in Memphis. EPA Region 4 is reviewing these concerns, working with the Shelby County Health Department to better understand the specific details, and consulting with other EPA offices." |

Source: Analysis of Public Citizen’s Corporate Enforcement Tracker

Big Tech’s ties within the Trump administration extend far beyond Elon Musk, though Musk and the informal “PayPal Mafia” network of tech executives who formerly played managing roles at the digital payments business play an outsized role. A review by the Revolving Door Project, a conflicts of interest watchdog group, found that out of more than 100 DOGE staffers, more than half were identified as having ties to Musk or Palantir co-founder Peter Thiel, the purported don of the PayPal Mafia. NBC News identified dozens associated with the PayPal Mafia network of billionaire executives taking a hands-on approach to the incoming Trump administration, including the venture capitalist-turned-tech-“czar” David Sacks, crypto and AI investor Marc Andreessen, and Thiel. Dubbed the “broligarchy,” the loose network’s goals apparently include dismantling any federal agency with the authority to restrain Big Tech’s abuses.

These executives, lobbyists, venture capitalists, and others whose financial fates are intimately entwined with increasing tech sector profits guided the transition to Trump’s presidency and assumed powerful roles within the administration. Others are exerting extraordinary influence as outside advisors (see Table 5).

Table 5: Trump Administration Officials and Insiders with Ties to Technology Corporations Facing Enforcement on January 20, 2025

| First Name | Last Name | Role in Trump Administration | Ties With Corporations Facing Enforcement |

|---|---|---|---|

| Daniel | Abrahamson | Appointed senior advisor to the Office of the Secretary at the Department of Transportation | Former senior counsel at Tesla |

| Marc | Andreessen | During the transition period, interviewed candidates for senior government roles and helped recruit employees for Musk's DOGE effort. | Corporations backed by the venture capital firm Andreessen Horowitz include Coinbase, Facebook, Instagram, Lyft, OpenAI, OpenSea, Robinhood, SpaceX, Uniswap, xAI, and Yuga Labs |

| Anthony | Armstrong | Senior Advisor in the White House Office of Personnel Management | A banker, Armstrong advised Musk on the purchase of Twitter and advised Activision Blizzard in the merger it sought with Microsoft |

| Brian | Armstrong | Privately met with Trump in November to advise the president-elect on appointments | CEO of Coinbase |

| Brian | Ballard | Head of Florida-based lobbying firm Ballard Partners, a longtime Trump ally | Lobbying clients include Amazon, TikTok parent ByteDance, Ripple, and Robinhood |

| Jared | Birchall | Interviewed candidates for high-level government positions and advised the transition team on policies including AI and crypto | Birchall manages Musk's family office and is nominally a Neuralink executive |

| Brian | Bjelde | Named senior advisor to the White House Office of Personnel Management | A longtime employee of Elon Musk's SpaceX who helped Musk carry out widespread layoffs at Twitter when Musk took over. |

| Pam | Bondi | Longtime Trump ally now leading Trump's Justice Department as Attorney General | Bondi was a registered corporate lobbyist for Amazon and Uber in 2020 |

| Doug | Burgum | Interior Secretary | A former Microsoft executive, following its acquisition of a software company Burgum founded |

| Steve | Davis | A DOGE leader within the government, departed from government with Elon Musk | Former SpaceX and Boring Company executive, helped Musk carry out layoffs at Twitter |

| Dario | Gil | Nominated to serve as Energy Undersecretary for Science and Innovation | Prior to his nomination, Gil was an IBM executive and research director focused on developing AI and emerging technologies |

| Antonio | Gracias | Assisted with Elon Musk's DOGE effort | The founder and CEO of the VC firm Valor Equity Partners, Gracias is known as a longtime Musk associate. A current SpaceX and former Tesla board member, Valor's portfolio includes the Musk companies The Boring Company, Neuralink, SpaceX, Tesla, and xAI |

| Travis | Kalanick | During the transition period, interviewed candidates for senior government roles and helped recruit employees for Musk's DOGE effort. | Co-founder and former CEO of Uber |

| David | Keeling | Nominated to lead the Occupational Health and Safety Administration | Former safety executive at Amazon, when the company was cited numerous times for “serious violations of Section 5(a)(1) of the Occupational Safety and Health Act (“OSH Act”) for Amazon’s failure to furnish a place of employment which was free from recognized hazards that were causing or likely to cause death or serious physical harm to employees |

| Michael | Kratsios | Nominated to serve as the director of the White House Office of Science and Technology Policy and conducting interviews of prospective DOGE staff. | Most recently spent four years as managing director for Scale AI |

| Sriram | Krishnan | Nominated to serve as Senior White House AI Adviser | Became partner at venture capital firm Andreessen Horowitz in 2020, where he recently led early-stage crypto investments in Europe at the firm's London office. Previously worked at Microsoft, focused mostly on Azure cloud services. Subsequently served in senior roles at Snap, Facebook, and Twitter. Reportedly a "trusted confidant" of Elon Musk |

| Scott | Kupor | Nominated to direct the White House Office of Personnel Management and assisted with DOGE | Most recently a partner at Andreessen Horowitz (first employee). Former executive at Hewlett Packard and Opsware (which HP acquired). Author of a book on venture capital investing blurbed by former Google executive Eric Schmidt and OpenAI CEO Sam Altman |

| Howard | Lutnick | Lutnick oversaw the Trump administration's transition team and was nominated to serve as Commerce Secretary | Lutnick was chief executive of the investment bank Cantor Fitzgerald, which manages assets for Tether |

| Shaun | Maguire | A longtime Trump supporter who reportedly donated $300,000 to support Trump's election, Maguire interviewed candidates to work for DOGE | A Musk ally and partner at the VC firm Sequoia Capital whose personal portfolio includes The Boring Company, SpaceX, xAI, and X (formerly Twitter) |

| Eliezer | Mishory | Leading DOGE efforts within the SEC | Formerly the chief regulatory officer at the betting markets firm Kalshi |

| Elon | Musk | Spent more than $290 million to help elect Trump, served in an advisory role during the transition, and led DOGE until his formal departure from the government in May. | CEO of The Boring Company, Neuralink, SpaceX, Tesla, xAI, and X (formerly Twitter) |

| David | Sacks | Trump appointed Sacks to serve as the White House AI & Crypto Czar | A former PayPal executive, Sacks was most recently a partner at the venture capital firm Craft Ventures, where he has made "notable investments" in Facebook, Lyft, SpaceX, Twitter, and Uber. Additional corporations Craft Ventures is invested in include: Meta, Neuralink, The Boring Company, and xAI |

| Amanda | Scales | Chief of Staff at the White House Office of Management and Budget | A former HR executive with Musk’s xAI and Uber |

| Gail | Slater | Nominated to lead the DOJ'S Antitrust Division as Assistant Attorney General | Slater worked as general counsel for the Internet Association, for which she lobbied Congress on antitrust legislation as recently as 2023. The Internet Association, which dissolved in 2021, was a lobbying group representing many of the largest tech corporations, including Google, Facebook, Amazon, Microsoft, Paypal, eBay, Twitter, and Uber |

| Peter | Thiel | Trump and Vance backer and ally, seen as leader of informal "PayPal Mafia" network | Co-founder of PayPal and of the venture capital firm Founders Fund, whose portfolio includes The Boring Company, Facebook, Lyft, Neuralink, OpenAI, Polymarket, Scale AI, and SpaceX |

Source: Analysis of Public Citizen’s Corporate Enforcement Tracker

How did the technology sector achieve so much power under the second Trump administration? One undeniable factor is money.

Tech sector corporations and billionaires using their wealth to maximize their political influence include:

- Howard Lutnick, the Tether banker turned Commerce Secretary, who spent $14 million backing Republicans in 2024.

- Tech corporations facing federal enforcement actions, who collectively gave $25 million to the Trump-Vance inaugural committee.

- Amazon, whose licensing deal for a documentary about Melania Trump reportedly includes a payment of $28 million for the first lady, and whose decision to stream reruns of the Trump reality show The Apprentice also reportedly will generate personal revenue for Trump.

- Corporations facing enforcement that collectively spent $75.7 million on lobbying during the first half of 2025, including Meta ($13.8 million), Amazon ($9 million), and Google ($6.3 million).

- Republican-backing venture capitalists, including big tech investors from Andreessen Horowitz, ARK Invest, and Sequoia Capital, who collectively spent more than $90 million.

- Jeffrey Yass, an investor with a 7% stake in TikTok’s parent ByteDance – reportedly worth $21 billion – who spent over $100 million backing Republicans in 2024 and gave $16 million to a Trump-backing super PAC in 2025.

- Crypto corporations facing federal enforcement – especially Coinbase and Ripple – that organized the pro-crypto super PAC Fairshake, which spent over $130 million boosting pro-crypto candidates and attacking critics.

- Justin Sun, a crypto billionaire whose businesses face enforcement lawsuits from the SEC and DOJ, spent $193 million on Trump crypto ventures World Liberty Financial and the $TRUMP “meme coin.”

- Elon Musk, who spent $290 million of his personal wealth helping elect Trump to the White House in 2024 and gave more than $50 million to Trump-backing super PACs in the first half of 2025.

- These tech corporations, along with their executives and investors, collectively spent $1.2 billion on political influence in the 2024 elections and the Trump administration. Two-thirds of the political spending – $610 million out of $863 million – was spent backing Republicans, including Trump.

Table 6: Top Ten Political Influence Spenders During and Since the 2024 Elections Tied to Tech Corporations Facing Enforcement

| Spender | Trump Inaugural Donation | Political Spending | Political Lean | Payments to Trump Businesses | Lobbying Spending | Sum |

|---|---|---|---|---|---|---|

| Elon Musk and Tesla, SpaceX, and X | $351,000,000 | Republican | $1,360,000 | $352,360,000 | ||

| Justin Sun (CEO of Tron Foundation Limited, BitTorrent Foundation, Rainberry) | $193,600,000 | $193,600,000 | ||||

| Jeffrey and Janine Yass (ByteDance investor) | $116,000,000 | Republican | $116,000,000 | |||

| Coinbase | $1,000,000 | $73,000,000 | Single-issue / bipartisan | $2,130,000 | $76,130,000 | |

| Ripple | $4,900,000 | $49,300,000 | Single-issue / bipartisan | $840,000 | $55,040,000 | |

| Dustin Moskovitz (Facebook co-founder) | $50,000,000 | Democratic | $50,000,000 | |||

| Ben and Felicia Horowitz (a16z) | $44,100,000 | Bipartisan | $43,600,000 | |||

| Marc Andreessen (a16z) | $43,600,000 | Republican | $40,625,000 | |||

| Amazon | $1,000,000 | $28,000,000 | $9,090,000 | $38,090,000 | ||

| Reid Hoffman (former PayPal executive) | $31,525,600 | Democratic | $31,525,600 |

Source: Analysis of Public Citizen’s Corporate Enforcement Tracker and publicly disclosed political influence data available via OpenSecrets.org

While the $863 million in political spending tied to tech corporations facing enforcement favored Republicans, its bipartisan nature sought to guarantee that no matter who won the White House or congressional majority, tech titans would have powerful allies within the highest office and the authority to prioritize the interests of their industry over the American people.

Now, with Trump in the White House and several senior administration officials allied with tech sector lawbreakers, tech sector corporations facing enforcement are benefiting from Trump’s corporate enforcement retreat.

Ten Tech Sector Beneficiaries of the Trump’s Enforcement Retreat:

BitMEX, a cryptocurrency exchange platform, pled guilty along with three executives and one employee during the final months of the Biden administration to willfully violating the Bank Secrecy Act, the federal law requiring financial corporations to prevent their businesses from being used illegally to facilitate money laundering. The corporation, which is formally incorporated as HDR Global Trading Limited in the Republic of Seychelles, was sentenced five days before Trump’s inauguration to pay a $100 million fine and serve two years of probation. The executives were sentenced in 2022 to house arrest and probation.

Two months after taking office, Trump signed presidential pardons for the BitMEX executives and, in a historic first, the corporation itself. The corporate pardon includes “remission of any and all fines, penalties, forfeitures, and restitution ordered by the court” – meaning BitMEX will never have to pay its $100 million fine.

*

Branch Messenger, a financial technology corporation that provides a payment platform businesses use to pay workers, was sued by the CFPB alongside Walmart for forcing delivery drivers to use accounts that allegedly harvested more than $10 million in junk fees from them.

Additional allegations against Branch included “failing to investigate alleged errors, failing to honor stop payment requests, failing to maintain necessary records, failing to provide certain disclosures, and illegally requiring consumers to waive their rights under the law.”

Trump fired CFPB director Rohit Chopra, who filed the case, before the end of his five-year term and named Treasury Secretary Scott Bessent acting director. Bessent froze CFPB litigation. Shortly thereafter, Trump’s Office of Management and Budget director Russ Vought was named acting CFPB director. Vought closed the CFPB offices and ordered all staff not to “perform any work tasks,” effectively halting at all ongoing CFPB cases and investigations, including the Branch Messenger case.

In May, Trump’s CFPB dropped the lawsuit against Branch and Walmart, which gave $150,000 to Trump’s inaugural fund.

*

Cognizant, a multinational information technology corporation, faced a federal investigation into its engaging in a criminal foreign bribery scheme in India. The DOJ under the first Trump administration declined to prosecute the $2 million bribery scheme “despite the fact that certain members of senior management participated in and directed the criminal conduct at issue.”

The DOJ then indicted two Cognizant executives for alleged criminal violations of the Foreign Corrupt Practices Act. Their trial was set to begin in March 2025.

Following an executive order Trump signed in February halting FCPA enforcement, DOJ prosecutors dismissed the bribery case against the Cognizant executives. Cognizant gave $50,000 to Trump’s inaugural committee.

*

Coinbase, a cryptocurrency exchange platform that spent $52 million during the 2024 elections, primarily to a super PAC backing pro-crypto candidates, was charged by the Securities and Exchange Commission in 2023 for operating as an unregistered securities exchange and other securities violations. The unlawful activity allegedly allowed the corporation to make billions of dollars facilitating trading of cryptocurrencies.

One month into the Trump administration, Coinbase announced that Trump’s SEC agreed to dismiss its case against the company.

Trump campaigned as an ally of the crypto sector and characterized enforcement against crypto businesses as unfair “weaponization” of the government, echoing Coinbase CEO Brian Armstrong’s characterization of SEC enforcement. Coinbase donated $1 million toward Trump’s inaugural fund, and Armstrong attended the celebratory Crypto Ball along with administration insiders, including AI and Crypto Czar appointee David Sacks, soon-to-be-Treasury Secretary Scott Bessent, and soon-to-be-Commerce Secretary Howard Lutnick. To help advance its interests before the administration, Coinbase hired the Trump campaign’s 2024 co-manager, Chris LaCivita, as an advisor.

*

eBay, the Silicon Valley-based online auction platform and Fortune 500 company, has been fighting a lawsuit by the DOJ’s Environment and Natural Resources Division over sales of illegal pesticides, diesel defeat devices, and other unlawful products since 2023, alleging violations of product safety and anti-pollution laws.

A federal judge in September dismissed the DOJ lawsuit, agreeing with eBay’s argument that Section 230 of the Communications Decency Act shields the auction platform from liability. The DOJ appealed the ruling in November.

To lobby federal agencies and Congress, eBay hired Miller Strategies, a lobbying firm founded by Trump Inauguration finance chair Jeff Miller. In April, Trump’s DOJ dismissed its own appeal, ending the case.

*

Meta, the social media giant behind Facebook and Instagram, has been facing a federal investigation by the Consumer Financial Protection Bureau, and lawsuits by the National Labor Relations Board and Federal Trade Commission. The Trump administration halted enforcement and regulatory oversight being performed by the CFPB, and fired NLRB commissioners and the board’s top lawyer, paralyzing its ability to finalize enforcement decisions.

The halted CFPB investigation into Meta was looking into the company’s alleged improper use of user financial data obtained from third parties for advertising purposes, part of its inquiry into potential misconduct by big tech payment platforms.

The Meta NLRB cases allege unfair labor practices and cover up to 65,000 employees. One case alleges the non-disparagement agreements forced on over 7,000 employees laid off in 2022 unlawfully violated workers’ rights to organize.

The FTC antitrust case alleging Meta illegally maintained a social networking monopoly has gone to trial despite CEO Mark Zuckerberg’s reported attempts at lobbying for a settlement.

Meta donated $1 million toward Trump’s inaugural fund, and Zuckerberg stood among the big tech oligarchs on the dais behind Trump during the inauguration ceremony. Rick Dearborn, who lobbied for Meta in 2024, worked on Trump’s 2016 transition team and in the White House, and authored a section of Project 2025. David Sacks, who Trump appointed to be the White House “AI & Crypto Czar,” made a “notable investment” in the company according to the Craft Ventures website. Trump ally Marc Andreessen is a member of Meta’s board of directors.

*

PayPal, a multinational financial technology and payment processing corporation, began the Trump administration facing investigations by the Consumer Financial Protection Bureau, the Federal Trade Commission, and the Securities and Exchange Commission.

Several former PayPal executives and investors who constitute the “PayPal Mafia” are particularly influential in the Trump administration, including Elon Musk, Trump’s AI & Crypto Czar David Sacks, and billionaire megadonor Peter Thiel.

Corporate filings say the FTC investigation, which began in 2022, is related to PayPal’s business customers submitting charges on behalf of other sellers. The CFPB investigation, first disclosed in 2023, relates to how the company resolves errors for consumers. The SEC investigation, also disclosed in 2023, related to the company’s movement into the cryptocurrency sector, specifically its development of its PYUSD stablecoin.

PayPal gave $250,000 to Trump’s inaugural fund.

The CFPB investigation of PayPal is presumably frozen. Trump fired CFPB director Rohit Chopra before the end of his five-year term and named Treasury Secretary Scott Bessent acting director. Shortly thereafter, Trump’s Office of Management and Budget director Russ Vought was named acting CFPB director – and Vought closed the CFPB offices and ordered all staff not to “perform any work tasks,” effectively halting at all ongoing CFPB cases and investigations, presumably including the PayPal investigation. In corporate filings, PayPal continues to report on the investigation’s existence.

The SEC investigation, like 19 other SEC enforcement actions involving cryptocurrency corporations, was dropped. The announcement followed the release of an SEC guidance document stating that the agency will not consider stablecoins to be securities that require registration.

Like the CFPB investigation, PayPal’s quarterly filings continue to report the FTC investigation’s existence.

*

ScaleAI, an artificial intelligence startup, faced an investigation by the Department of Labor brought under the Fair Labor Standards Act into unpaid wages, worker misclassification, and retaliation. Former contractors for the company have alleged wage theft and widespread labor abuse, and the corporation has been accused of operating “digital sweatshops” in the Global South to train AI systems.

ScaleAI has partnered with Amazon, Microsoft, Nvidia, and OpenAI, and Meta recently acquired a 49% stake in the company for $15 billion.

ScaleAI donated $125,000 to Trump’s inaugural fund, and Trump nominated former ScaleAI executive Michael Kratsios to be director of the White House’s Office of Science and Technology Policy.

In May, Trump’s DOL dropped enforcement of a rule to protect workers from being misclassified by their employers as independent contractors. Shortly thereafter, the DOL informed workers it would not enforce its subpoena into ScaleAI’s conduct and that it was dropping the case entirely along with parallel investigations into ScaleAI partners HireArt and Upwork.

*

Solo Funds, a financial technology platform, was sued by the Consumer Financial Protection Bureau in May of 2024 for misleadingly advertising itself as a zero-interest alternative to high-cost payday loans while employing deceptive dark patterns to trick consumers into paying fees with annual percentage rates as high as 1,000%.

Trump fired CFPB director Rohit Chopra before the end of his five-year term and named Treasury Secretary Scott Bessent acting director. Bessent froze CFPB litigation. Shortly thereafter, Trump’s Office of Management and Budget director Russ Vought was named acting CFPB director – and Vought closed the CFPB offices and ordered all staff not to “perform any work tasks,” effectively halting at all ongoing CFPB cases and investigations, including the Solo Funds Case.

On February 21, Trump’s CFPB filed to dismiss the Solo Funds case with prejudice. In a post defending the case’s dismissal, Vought wrote, “More to come but the weaponization of ‘consumer protection’ must end.”

*

SpaceX, Elon Musk’s rocket technology corporation, has been facing a lawsuit filed by the DOJ’s Civil Rights Division since August of 2023 accusing the business of discriminating against asylum recipients and refugees in hiring decisions. According to the DOJ, SpaceX allegedly routinely discouraged asylum recipients and refugees from applying for jobs and refused to hire or consider them because of their citizenship status over a period of four years, a violation of the Immigration and Nationality Act.

SpaceX retaliated soon after with a federal lawsuit challenging the constitutionality of the DOJ case. A federal court in Texas issued a temporary stay, pausing the DOJ lawsuit. The DOJ filed to lift the stay.

Two days after taking office, Trump’s DOJ ordered a freeze on all Civil Rights Division cases, halting the SpaceX case along with at least eight other corporate cases. On February 20, Trump’s DOJ filed to dismiss the SpaceX discrimination case.

SpaceX CEO Elon Musk spent more than $290 million helping elect Trump. SpaceX employed Miller Strategies, a lobbying firm founded by Trump Inauguration finance chair Jeff Miller. David Sacks, who Trump appointed to be the White House “AI & Crypto Czar,” made a “notable investment” in the company according to the Craft Ventures website.

Tech Sector Enforcement Concerns

Antitrust

Blockbuster trials against Google and Meta alleging illegal monopolization have made antitrust appear to be a category of enforcement the Trump administration is continuing despite corporate pressure to retreat.

The Department of Justice case against Google for illegal monopolization in search and the Federal Trade Commission case against Facebook (now Meta) for illegal monopolization both were originally filed under the previous Trump administration. Under Biden, the DOJ brought a second antitrust case against Google for illegal monopolization in the digital advertising market and successfully re-filed the Facebook antitrust case after a federal judge dismissed the original case.

Meta gave $1 million to Trump’s inauguration and agreed to pay Trump $25 million to settle a lawsuit Trump brought after his suspension from Facebook and Instagram. CEO Mark Zuckerberg visited Trump’s White House several times after the inauguration in an attempt to head off its antitrust trial, which began on April 14 and concluded on May 27. The CEO offered to pay $450 million to settle the case; the FTC had demanded $30 billion. FTC chair Andrew Ferguson and DOJ antitrust chief Gail Slater met with Trump in the Oval Office, where they persuaded the president to allow the case to proceed. Many Trump supporters blame Meta for Trump’s election loss in 2020.

Google also gave $1 million to Trump’s inauguration and lobbied the Trump administration to drop the antitrust enforcement against it. In the Google search monopolization case, Trump’s DOJ is continuing to push for the corporation to divest its Chrome web browser. However, Trump’s DOJ will no longer call for Google to also divest its AI business.

These antitrust cases are the most high-profile exceptions to the Trump administration’s retreat from corporate enforcement. Gail Slater, former general counsel of the disbanded Internet Association, which lobbied the on behalf of Big Tech corporations, has sought to reframe antitrust enforcement as a MAGA cause. In Slater’s first speech as head of the DOJ’s Antitrust Division, she describes her vision of “America first antitrust enforcement.” Slater insists, “[A]ntitrust in the United States is law enforcement. It is not regulation.” Going further, Slater argues that “preference for litigation over regulation” is a “conservative value.”

This argument is more than a little discordant with Trump administration officials and their corporate allies, who, when facing allegations of misconduct, have repeatedly decried “regulation by enforcement,” a phrase that has become shorthand for corporatists when trying to discredit strong enforcement against corporate violations. SEC chair Paul Atkins, acting CFPB director Russ Vought, and acting CFTC chair Caroline Pham have all, in recent months, used the phrase to describe what they characterize as an excessively heavy handed enforcement approach under Biden.

However, while the Google and Meta anti-monopoly cases proceed, lax merger enforcement has apparently returned. Among the mergers the Trump administration has permitted is Hewlett Packard Enterprise’s acquisition of Juniper Networks, which represents an instance of remarkable consolidation in its market.

In a review of the Trump administration’s antitrust policies, the American Economic Liberties Project’s Matt Stoller recently observed, “Trump, and his [antitrust] enforcers, at first looked fierce, but they have turned into Bush-style establishment types.”

Big Tech corporations facing antitrust enforcement investigations and lawsuits the Trump administration inherited from the Biden administration also include Amazon, Apple, and Nvidia (see Table 7). Trump’s antitrust enforcers at the DOJ also have initiated a probe whether the business partnership between Google and CharacterAI was crafted to avoid formal antitrust scrutiny.

Table 7: Eleven Big Tech corporations facing antitrust enforcement actions the Trump administration inherited from the Biden administration

| Corporation | Agency | Subject of Investigation or Allegation | Status | Trump Admin Ties |

|---|---|---|---|---|

| Activision | FTC | Anticompetitive Microsoft-Activision merger sought | Dismissed, merger permitted | |

| Amazon | FTC | Acting as a monopolist among e-commerce superstores and fulfillment providers | Antitrust suit filed | Amazon's licensing deal for a documentary about Melania Trump reportedly includes a payment of $28 million. Amazon announced a licensing deal to stream all seven seasons of The Apprentice, resulting in unspecified payments to Trump, who starred and was executive producer. Amazon announced a licensing deal to stream all seven seasons of The Apprentice, resulting in unspecified payments to Trump, who starred and was executive producer. Amazon donated $1 million toward Trump's inaugural fund and made a $1 million in-kind donation by streaming the event on Amazon Video. Amazon donated $1 million toward Trump's inaugural fund and made a $1 million in-kind donation by streaming the event on Amazon Video. Attorney General Pam Bondi worked as a registered lobbyist for Amazon in 2020 and 2021. Trump ally Brian Ballard lobbied on Amazon's behalf in 2024. |

| Apple | DOJ | Smartphone market monopoly violations | Antitrust suit filed | Apple CEO Tim Cook donated $1 million toward Trump's inaugural fund. Apple employs Miller Strategies, a lobbying firm founded by Trump Inauguration finance chair Jeff Miller. Apple CEO Tim Cook personally gifted Trump a glass sculpture of the Apple logo with a 24-karat gold base during a meeting at the Oval Office |

| DOJ | Monopoly violations in advertising | Judge ruled Google violated Sections 1 and 2 of the Sherman Act | Google donated $1 million to Trump's inaugural fund. | |

| Monopoly violations in search | Breakup plan proposed | |||

| Hewlett Packard Enterprise | DOJ | Anticompetitive Hewlett Packard Enterprise-Juniper Networks merger sought | Settled, merger permitted with divestitures | HPE donated $250,000 to Trump's 2024 inaugural fund. HPE hired Trump administration allies Mike Davis and Arthur Schwartz to advocate for the merger |

| Juniper Networks | DOJ | Anticompetitive Hewlett Packard Enterprise-Juniper Networks merger sought | Settled, merger permitted with divestitures | HPE donated $250,000 to Trump's 2024 inaugural fund. HPE hired Trump administration allies Mike Davis and Arthur Schwartz to advocate for the merger |

| Lyft | FTC | Whether Uber Technologies Inc. and Lyft Inc. illegally coordinated to limit driver pay in New York City. | Antitrust investigation disclosed | |

| Meta | FTC | Social media monopoly violations | Antitrust suit filed | Meta donated $1 million toward Trump's inaugural fund. Trump ally Marc Andreessen is a member of Meta's board of directors. Rick Dearborn, who lobbied for Meta in 2024, worked on Trump's 2016 transition team and in the White House, and authored a section of Project 2025. David Sacks, who Trump appointed to be the White House "AI & Crypto Czar," made a "notable investment" in the company according to the Craft Ventures website. |

| Microsoft | FTC | Anticompetitive actions related to AI and cloud computing services | Antitrust investigation reportedly opened | Microsoft donated $1 million toward Trump's inaugural fund. |

| Anticompetitive Microsoft-Activision merger sought | Dismissed, merger permitted | |||

| Whether Microsoft structured its deal with AI startup Inflection to avoid a government antitrust oversight. | Antitrust investigation reportedly opened | |||

| Nvidia | DOJ | Allegations the company abused its market dominance | Antitrust investigation ongoing | Nvidia CEO Jensen Huang attended a $1 million-a-head fundraiser at Mar-a-Lago for Trump's MAGA Inc super PAC on 4/4/25 |

| Realpage | DOJ | Unlawful scheme to decrease competition among landlords in apartment pricing and to monopolize the market for commercial revenue management software that landlords use to price apartments | Antitrust suit filed |

Source: Analysis of Public Citizen’s Corporate Enforcement Tracker

Artificial Intelligence

The rise of generative AI systems, starting in 2022 with OpenAI’s release of ChatGPT, has spawned numerous risks for the public and an array of commercial opportunities for the corporations behind the technology.

At the center of the push to install AI systems into every phone, computer, workplace, and school are several Trump administration insiders, including:

- Elon Musk, who co-founded OpenAI with Sam Altman, heads his own AI business, xAI, and has long pushed Tesla, the electric car company he heads, to focus on self-driving vehicles and robotics;

- David Sacks, the White House Crypto and AI Czar, whose venture capital firm Craft Ventures has backed a number of tech firms, has recently announced divestments from AI corporations, including Musk’s xAI and Meta;

- Marc Andreessen, whose venture capital firm Andreessen Horowitz backs several AI firms, including those facing federal enforcement and investigations such as CharacterAI, OpenAI, and Musk’s xAI;

- Michael Kratsios, director of the White House’s Office of Science and Technology Policy under Trump and former executive at Scale AI, which with its partners HireArt and Upwork faced a Department of Labor investigation that the Trump administration abruptly closed; and

- Sriram Krishnan, a senior White House AI advisor and former Andreessen Horowitz partner who previously worked in senior roles for Microsoft and Snap.

Soon after taking office, Trump signed an executive order rolling back parts of President Biden’s AI policies. Through the administration’s deregulatory DOGE initiative, the administration is reportedly seeking to replace thousands of federal employees with AI and intends to launch a public-facing AI system.

The AI Action Plan the administration released in July shows that investigations and enforcement actions targeting AI corporations are likely to be dropped. The plan explicitly recommends a review of all investigations Trump’s FTC inherited from Biden’s FTC “to ensure that they do not advance theories of liability that unduly burden AI innovation,” and additionally recommends a review of “all FTC final orders, consent decrees, and injunctions, and, where appropriate, seek to modify or set-aside any that unduly burden AI innovation.”

The ongoing FTC enforcement actions the plan seems to place most at risk are the consumer protection investigations into OpenAI and Snap and the Microsoft antitrust cases involving AI. Additionally, several Big Tech corporations are bound by FTC orders that could be weakened or withdrawn, including Amazon, Apple, Google, Meta, and X (formerly Twitter).

Three of the twelve AI companies previously in the crosshairs of federal enforcement have seen their cases withdrawn (see Table 8).

Table 8: Twelve AI corporations facing enforcement actions the Trump administration inherited from the Biden administration

| Corporation | Agency | Subject of Investigation or Allegation | Status | Known Trump Administration Ties |

|---|---|---|---|---|

| Ascend Ecom | FTC | Allegedly falsely claiming its “cutting edge” AI-powered tools would help consumers quickly earn thousands of dollars a month in passive income by opening online storefronts, defrauding consumers of at least $25 million. | Settled | |

| Ecommerce Empire Builders | FTC | Falsely claiming to help consumers build an “AI-powered Ecommerce Empire” by participating in its training programs that can cost almost $2,000 or by buying a “done for you” online storefront for tens of thousands of dollars | Settled | |

| FBA Machine | FTC | Allegedly falsely promising consumers that they would make guaranteed income through online storefronts that utilized AI-powered software, costing consumers more than $15.9 million | Civil lawsuit ongoing | |

| HireArt | DOL | Related to investigation into Scale AI's compliance with the Fair Labor Standards Act | Trump's DOL closed the investigation into Scale AI, Upwork, and HireArt on 5/9/25. | |

| Innodata Inc | DOJ, SEC | Allegedly false and misleading statements regarding the company’s AI technology and services. | Investigation disclosed | |

| Liveperson Inc | DOJ, FDA, CMS | Products and services related to COVID-19 testing and accompanying software | Investigation disclosed | |

| OpenAI | SEC | Investigating internal communications to understand if investors were misled | Investigation reported | CEO Sam Altman donated $1 million toward Trump's inaugural fund. OpenAI hired Miller Strategies, a lobbying firm founded by Trump Inauguration finance chair Jeff Miller, to lobby federal agencies and Congress on AI. |

| FTC | Consumer harms from data collection and misinformation | Investigation opened | ||

| Scale AI | DOL | Compliance with the Fair Labor Standards Act, specifically unpaid wages, misclassification, and retaliation | Trump's DOL closed the investigation into Scale AI, Upwork, and HireArt on 5/9/25. | ScaleAI donated $125,000 to Trump's inaugural fund. Trump nominated former Scale AI executive Michael Kratsios to be director of the White House’s Office of Science and Technology Policy |

| Snap | FTC, DOJ | The complaint pertains to the company’s deployment of an artificial intelligence powered chatbot, My AI, in its Snapchat application and the allegedly resulting risks and harms to young users of the application. | FTC referred complaint to DOJ over objections of then-commissioner, now-FTC Chair Andrew Ferguson | |

| Tempus AI | DOJ | Investigation into compliance with False Claims Act and Anti-Kickback laws with emphasis on the Medicare 14-Day or Date of Service Rule | Investigation disclosed | |

| Upwork | DOL | Related to investigation into Scale AI's compliance with the Fair Labor Standards Act | Trump's DOL closed the investigation into Scale AI, Upwork, and HireArt on 5/9/25. | |

| xAI | EPA | "EPA is aware of concerns that have been raised about air quality and regulatory applicability regarding the xAI facility in Memphis. EPA Region 4 is reviewing these concerns, working with the Shelby County Health Department (SCHD) to better understand the specific details, and consulting with other EPA offices." | Investigation reported | CEO is Elon Musk, who spent more than $290 million to help elect Trump and who led DOGE. Musk gave $50 million to Trump-backing super PACs in the first half of 2025. David Sacks, who Trump appointed to be the White House "AI & Crypto Czar," made a "notable investment" in the company according to the Craft Ventures website. |

Source: Analysis of Public Citizen’s Corporate Enforcement Tracker

Cryptocurrency

No corporate sector has benefited from the Trump administration’s retreat from law enforcement like the crypto sector has.

During his first term, President Trump was outspoken in his crypto skepticism, and the Securities and Exchange Commission (SEC) under Trump pursued vigorous enforcement actions against crypto businesses for securities law violations. “I am not a fan of Bitcoin and other Cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air. Unregulated Crypto Assets can facilitate unlawful behavior, including drug trade and other illegal activity,” Trump posted on Twitter in 2019.

Fast-forward to 2025, after crypto spending made up nearly half of the corporate money in the 2024 election and Trump’s full embrace crypto includes his private business launching multiple crypto ventures, bringing in profits estimated in the hundreds of millions. According to research by Accountable.US, nearly three quarters of Trump’s private wealth is from his crypto ventures.

An April 7 memo titled “Ending Regulation by Prosecution” announcing the DOJ’s pullback from enforcement against cryptocurrency corporations stated it “will not pursue actions against the platforms that [criminal] enterprises utilize to conduct their illegal activities,” and made plain that “[o]ngoing investigations that are inconsistent with the foregoing should be closed.”

So far, the Trump administration has dismissed or withdrawn enforcement actions against 20 crypto corporations, and frozen enforcement against three (see Table 9).

Trump also signed the first-ever presidential pardon for a corporation – the crypto corporation BitMEX – which now will never have to pay its $100 million fine.

The culmination of the crypto sector’s influence was the July 25 signing ceremony for the so-called GENIUS Act, a bill that legitimizes stablecoins and furthers a slew of abuses. Among those present at the bill-signing ceremony were executives representing crypto corporations currently facing federal investigations and enforcement actions – and those whose cases Trump enforcement agencies recently dropped. These include executives from Coinbase, Gemini, Kraken, Ripple, Robinhood, and Tether.

At the bill signing, Trump remarked that under Biden, “half of you are under arrest for no reason whatsoever,” referencing enforcement actions crypto executives and corporations faced under the previous administration.

Table 9: Twenty-seven cryptocurrency corporations facing enforcement actions the Trump administration inherited from the Biden administration

| Corporation | Agency | Subject of Investigation or Allegation | Status | Trump Admin Ties |

|---|---|---|---|---|

| Binance | SEC | Thirteen charges, including operating unregistered national securities exchanges, broker-dealers, and clearing agencies, | Dismissed | Trump's family is reportedly in talks to purchase a stake in Binance's US subsidiary and to launch, through Trump's World Liberty Financial, a stablecoin on Binance's exchange. Binance CEO and majority shareholder Changpeng Zao is reportedly seeking a pardon from Trump after pleading guilty to failing to meet anti-money laundering requirements at Binance. |

| DOJ | Binance pleaded guilty in 2023 to violations related to the Bank Secrecy Act, failure to register as a money transmitting business, and the International Emergency Economic Powers Act | 2023 plea agreement requires three-year corporate monitor; the Trump DOJ has reportedly paused corporate monitorships and is considering whether to eliminate them altogether | ||

| BitMEX | DOJ | The corporate entity underlying BitMEX, HDR Global Trading Limited, pled guilty in July 2024 to violating the Bank Secrecy Act (BSA) by willfully failing to establish, implement, and maintain an adequate anti-money laundering program. The corporation was sentenced to two years of probation and fined $100 million. Four BitMEX founders and top executives also pled guilty to violating the BSA. | Trump pardoned the four BitMEX executives and the underlying entity, HDR Global Trading Ltd. in what appears to be the first-ever pardon of a corporation on 3/27/25. | |

| Coinbase | SEC | Charged with operating its crypto asset trading platform as an unregistered national securities exchange, broker, and clearing agency. The SEC also charged Coinbase for failing to register the offer and sale of its crypto asset staking-as-a-service program. | Dismissed | Coinbase donated $1 million toward Trump's inaugural fund. Coinbase hired the Trump campaign's 2024 co-manager, Chris LaCivita, as an advisor. |

| Consensys | SEC | Charged with engaging in the unregistered offer and sale of securities through a service it calls MetaMask Staking and with operating as an unregistered broker | Dismissed | Consensys donated $100,000 to Trump's inaugural fund |

| Crypto.com (Foris Dax) | SEC | Allegedly trading unregistered securities | Investigation closed | Crypto.com donated $1 million to Trump's inauguration and $10 million to MAGA Inc, a Trump-backing super PAC, under its business name, Foris Dax $TRUMP meme coins are traded on Crypto.com's platform. Crypto.com is reportedly partnering with Trump Media to launch ETFs |

| Cumberland DRW | SEC | Charged in October 2024 with operating as an unregistered dealer in more than $2 billion of crypto assets offered and sold as securities | Dismissal sought by Trump administration. | The month after Trump's SEC dismissed its case, Cumberland founder Don Wilson bought $100 million worth of shares in Trump Media & Technology Group to help the Trump business invest in cryptocurrency |

| Gemini | SEC | For the unregistered offer and sale of securities to retail investors through the Gemini Earn crypto asset lending program | Investigation closed | Twin brothers Cameron and Tyler Winklevoss, who together founded and run Gemini, contributed a $2.65 million to groups backing Trump for president. In the first half of 2025, the Winklevoss twins gave $1 million to MAGA Inc., a Trump-backing super PAC. |

| Gryphon Digital Mining | DOJ | Regarding whether the company qualified for forgiveness of its PPP loan | Investigation disclosed | |

| Horizen Labs | SEC | Related to the launch of ApeCoin cryptocurrency | Investigation closed | |

| Immutable Labs | SEC | Listing and private sales practices of cryptocurrency | Investigation dropped | |

| Jump Crypto | CFTC | Unspecified | Investigation reported, CEO resigned | |

| Kalshi | CFTC | The CFTC determined in 2023 that Kalshi's proposed contracts involve gaming and activity that is unlawful under state law and are contrary to the public interest, and so are prohibited and cannot be listed or made available for clearing or trading on or through Kalshi | Trump's CFTC on 5/5/25 dismissed its appeal of a ruling allowing Kalshi to take bets on US election outcomes | Trump named former Kalshi board member Brian Quintenz to serve as CFTC chair Kalshi named Donald Trump Jr. as a strategic advisor in January |

| Kraken (Payward) | SEC | Charged with operating crypto trading platform as an unregistered securities exchange, broker, dealer, and clearing agency. | Dismissed | Kraken co-founder Jesse Powell donated $1 million in cryptocurrency backing Trump for president. Kraken donated $1 million toward Trump's inaugural fund. |

| KuCoin | CFTC | Multiple violations of the Commodity Exchange Act and CFTC regulations | A CFTC attorney referenced the new chair's policy statement ending "regulation by enforcement" in a letter explaining its postponement of the KuCoin settlement. | |

| OpenSea | SEC | Alleged sale of unregistered securities | Trump administration reportedly filed to dismiss the case | Trump NFTs are bought and sold on OpenSea's platform |

| PayPal | SEC | PayPal's PYUSD stablecoin | Investigation closed | PayPal donated $250,000 to Trump's inaugural fund. Several former PayPal executives and investors who constitute the "PayPal Mafia" are particularly influential in the Trump administration, including Elon Musk, Trump's AI & Crypto Czar David Sacks, and billionaire megadonor Peter Thiel. |

| Polymarket | CFTC | Misconduct connected with betting on US elections | Trump’s CFTC closed the investigation | Polymarket CEO Shayne Coplan was invited to attend a crypto summit at the White House on 3/7/25 |

| DOJ | Misconduct connected with betting on US elections | Trump’s DOJ closed the investigation | ||

| Pulsechain | SEC | Allegedly conducting unregistered offerings of crypto asset securities | Dismissed by judge, SEC could appeal | |

| Ripple | SEC | Securities law violations | Trump's SEC is withdrawing its appeal of the Ripple lawsuit and allowing Ripple to pay just $50 million of its $125 million penalty. The withdrawn SEC appeal reportedly sought $2 billion in penalties. | Ripple donated $4.9 million worth of its cryptocurrency XRP to Trump's inaugural fund. Ripple Chief Legal Officer Stuart Alderoty donated $300,000 in cryptocurrency to back Trump for president. Ripple hired Trump ally Brian Ballard to lobby the administration on crypto issues. Trump chief of staff Susie Wiles is a former lobbyist with Ballard's firm. Ripple also retains Reince Priebus as a lobbyist, Trump's chief of staff during his first term as president. |

| Robinhood Markets | SEC | Securities violations within crypto unit | Dismissed | Robinhood donated $2 million toward Trump's 2024 inaugural fund. Robinhood hired Trump ally Brian Ballard to lobby on crypto issues in 2024. Trump chief of staff Susie Wiles is a former lobbyist with Ballard's firm. |

| SafeMoon | DOJ | Alleged conspiracy to commit securities fraud, conspiracy to commit wire fraud and money laundering conspiracy for their roles in defrauding investors in a decentralized finance digital asset called “SafeMoon” | CEO convicted | |